We ask you, urgently: don't scroll past this

Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you.Help Now >

The sinister tax that drives people to quit the Church

FREE Catholic Classes

In Germany, if you are baptized or Jewish, you must pay a monthly tax. The effect of this policy is driving people away from the church and synagogue. A few other faith communities, such as Muslims, are exempt.

German notgeld, emergency currency from the Weimar era. The flawed policies of this era helped lead Germany into its darkest chapter.

LOS ANGELES, CA (California Network) - If you are baptized as a Christian, or you are Jewish, then you automatically owe the government between eight and nine percent of your monthly income. Known as the "church tax," the government deducts this sum automatically from your paycheck. The money is paid to your denomination. Think of it as government-enforced tithing. However, it only applies to Christians and Jews. Muslims and Buddhists are exempt.

Churches collect about 12 billion euros via this government-enforced scheme, and it's been in effect since the Weimar era in Germany, first appearing in 1919.

The sum collected each year is dwindling. The reason is many people are quitting the church, granting themselves an automatic pay increase. A survey in 2021 found that a third of current parishioners are thinking about leaving the their churches over the tax. Combine this with global inflationary pressure, and it makes economic sense for a lot of people to leave.

When people leave, the church is notified by the government. Obviously, this can cause embarrassment and other problems.

Of course, there are some arguments to consider. First, as Christians, we should embrace persecution, in all its forms. As Jesus remarked, "Render unto Caesar." (Mark 12:17) Christians also should not be deterred from practicing their faith, even to the point of arrest, torture, or death. And certainly not over a tax. And finally, these monies flow to their church, something that is necessary to maintain the mission. But is this practice right? Is it just? Is it counter-productive? What effect is it having?

The practice also exists in other forms in many other European countries. Austria, Denmark, Italy, Spain, Switzerland, and Sweden all have some form of a tax for Christians. Implementation varies. However, Germany takes the most. It is always controversial.

To evade the tax, millions of Germans are leaving their churches. It is unclear if they continue attending afterwards, but many who pay the tax say they already stay home, and others say they don't even believe anymore. Atheism is on the rise in Europe, and taxes on the faithful cannot help.

As Christians, we are expected to give cheerfully and charitably. Giving that is compulsory isn't charitable. It doesn't produce the same kind of grace that giving out of love yields.

Nor should government be influencing public worship through taxation. With government money comes government rules. What difference does this make on public perception when the church is dependent on a secular government for its tithes?

Our faith practice isn't the business of any government. Nor should it be. Separation of church and state is an essential protection for individual conscience. These taxes are little different from the Muslim jizya tax Christians are compelled to pay under Sharia law. The fact the money goes to the church (after the government takes its cut to administer the program) is of little consolation. Doing the right thing the wrong way is still wrong. There are right things to do, and right ways to do them. This is not one of them. Especially when it has the effect of driving people away from the Church.

So many people are so poorly catechized, they will cut the weak ties they have with their faith community over any inconvenience. Ultimately, this is a problem for the Church, as it has a responsibility to preach the Gospel to these people, and to persuade them to grow in their faith. The fact that each person is responsible for their faith practice is no excuse for the Church. Catechesis is the mission of the Church. And anytime a secular authority uses its power to make this difficult, or impossible, the Church has a moral imperative to oppose it. It might mean less money for the Church, but right now, with receipts shrinking, the Church is dying anyway. It's time for a better approach, one that replaces government fiat with the Gospel --the only thing that actually works to fill the pews.

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

-

- Stations of the Cross

- Easter / Lent

- 5 Lenten Prayers

- Ash Wednesday

- Living Lent

- 7 Morning Prayers

- Mysteries of the Rosary

- Litany of the Bl. Virgin Mary

- Popular Saints

- Popular Prayers

- Female Saints

- Saint Feast Days by Month

- Pray the Rosary

Teaching Catholic Children the True Meaning of Easter: 5 Ways to Help Kids Understand the Resurrection of Christ

Catholic Pro-Life Groups Rally to Defund Planned Parenthood and Redirect Funds to Life-Affirming Health Centers

Trump’s New Tariffs Spark Global Economic Concerns

Daily Catholic

Daily Readings for Friday, April 04, 2025

Daily Readings for Friday, April 04, 2025 St. Isidore of Seville: Saint of the Day for Friday, April 04, 2025

St. Isidore of Seville: Saint of the Day for Friday, April 04, 2025 Guardian Angel Prayer: Prayer of the Day for Friday, April 04, 2025

Guardian Angel Prayer: Prayer of the Day for Friday, April 04, 2025 Daily Readings for Thursday, April 03, 2025

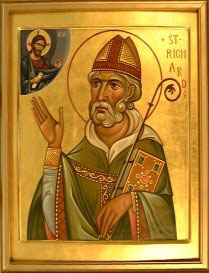

Daily Readings for Thursday, April 03, 2025 St. Richard of Wyche: Saint of the Day for Thursday, April 03, 2025

St. Richard of Wyche: Saint of the Day for Thursday, April 03, 2025- Act of Faith #6: Prayer of the Day for Thursday, April 03, 2025

![]()

Copyright 2025 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2025 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Friday, April 04, 2025

Daily Readings for Friday, April 04, 2025 St. Isidore of Seville: Saint of the Day for Friday, April 04, 2025

St. Isidore of Seville: Saint of the Day for Friday, April 04, 2025 Guardian Angel Prayer: Prayer of the Day for Friday, April 04, 2025

Guardian Angel Prayer: Prayer of the Day for Friday, April 04, 2025 St. Richard of Wyche: Saint of the Day for Thursday, April 03, 2025

St. Richard of Wyche: Saint of the Day for Thursday, April 03, 2025