We ask you, urgently: don't scroll past this

Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you.Help Now >

Tighter lending rules trip up homebuyers

FREE Catholic Classes

Milwaukee Journal Sentinel (MCT) After 22 years in an apartment, Jim and Kristin Moscicke decided it was time to buy their first home. A drop in Kristin's credit score means they'll continue renting for at least another year.

Highlights

McClatchy Newspapers (www.mctdirect.com)

3/26/2009 (1 decade ago)

Published in Home & Food

Even with interest rates at historic lows and billions of new government dollars flowing into the financial system, their experience demonstrates that getting a mortgage today often isn't as smooth as it used to be. The difference between wishing for and actually getting a great deal on a mortgage can be a few dozen points on a credit score, or a few thousand dollars on an appraisal.

Where a credit score above 620 might have qualified you for a competitive interest rate a couple of years ago, the magic number today is 740.

"Obviously things are more restrictive than they were three, six or 12 months ago," said Mike Monaghan, a mortgage adviser for Coldwell Banker Home Loans. "It's a more thorough process today."

Some in the business say those changes have returned an appropriate level of scrutiny _ some would say sanity _ to what had become the Wild West of lending. Others say the restrictions are too much, penalizing good borrowers and tossing common sense to the wind.

"Has the pendulum swung too far? I don't know. That's the market reality," said mortgage banker Brian Wickert, president of Accunet Mortgage in Butler, Wis.

Mortgage rates already were flirting with all-time lows last week when the Federal Reserve said on March 18 that it would pump another $1 trillion into the financial system, buying up $300 billion in long-term government bonds and $750 billion in mortgage-backed securities. That move cut another quarter point off 30-year mortgage rates, dropping them below 5 percent at some lenders _ and low rates are likely to stick around for a while, experts said.

"It's going to work. Rates are going to come down," said Anthony Pennington-Cross, an associate professor of finance at Marquette University and a former senior economist at the Federal Reserve Bank of St. Louis and the Office of Federal Housing Enterprise Oversight.

The hiccup, as Pennington-Cross calls it, is that only the best-qualified borrowers will be able to obtain the best rates. But that still leaves some less-qualified buyers the opportunity to get a mortgage at a rate slightly above the all-time lows, lenders said.

Government-owned Fannie Mae and Freddie Mac, which buy mortgages from lenders, are looking more closely at credit scores and appraisals. Both agencies are charging fees _ a percentage of the loan amount _ for loans that entail more risk; those fees are being passed directly to borrowers. Interest rates on such mortgages also are likely going to be higher than on mortgages going to people with optimum credit scores and big down payments.

It's no mystery why. For 2008, Fannie Mae lost $58.7 billion while Freddie Mac lost $50 billion.

"Fees are adjusted up and down based on market conditions," said Brad German, a spokesman for Freddie Mac. "The better the credit, the less likely it is that the loan will end up in a loss."

But Douglas Lenski, president of Wholesale Mortgage Services of Wisconsin LLC in Milwaukee, contends that Fannie and Freddie have gone too far in charging fees to reduce or eliminate risk. "They've over-tightened the screws." he said.

Anyone with a credit score below 740 could be hit with extra fees. For example, someone with a 700 to 719 credit score who has a 20 percent down payment would pay a 0.75 percent fee _ $1,500 _ on a $200,000 mortgage.

"I'd loan my own personal cash to someone with a 700 or 719 credit score," Lenski said.

The credit-score equation has changed quickly, Wickert said.

"Two years ago, it only mattered if your credit score was above or below 620," he said. "Eighteen months ago, top tier credit was anything above 660. Then it jumped to 680, 700, and now finally 740."

The situation is frustrating for John Scaffidi, owner of Complete Mortgage in Sussex, Minn.

"There's no common sense anymore," Scaffidi said. "There's nothing wrong with a 700 credit score.

"Every loan's a battle, and everything is changing daily," he added.

The credit-score squeeze is keeping the Moscickes out of the housing market for now.

Having lived in the same Sussex, Minn., apartment for two decades, Jim, 50, and Kristin, 47, decided the time was right to buy a condo.

They have $15,000 for a down payment, but their credit scores are holding them back. Jim fell behind on payments related to treatment of thyroid cancer, he said, and his credit is hovering below 600 _ but his medical bills are finally paid off, and the cancer is in remission.

"We finally thought that everything was going to be good," Jim said.

Kristin had a credit score of 763 last year, only to find four months later that it had dropped more than 100 points. The couple is looking into why the score dropped. So far, they say, they don't know what happened.

Even so, the Moscickes' current scores and down payment would likely have been good enough to qualify them for a mortgage 18 to 24 months ago, local lenders said. Today's steeper standards, however, have forced the couple to delay their plans.

"We'll get there," Jim said. "It's just going to take more work than we thought."

Michael Lopez encountered another of the realities of mortgage borrowing these days when he decided last month to refinance into a 15-year mortgage, aiming to pay off his house on Milwaukee's southwest side when he retires.

As is common with refinancings, an appraisal was done _ but Lopez was stunned when it came in almost $20,000 below an appraisal he had gotten just five months earlier when he had taken out a $25,000 home equity loan to pay for a new kitchen.

The October 2008 appraisal had valued his house at $190,000. "This time when the appraiser came out, he appraised my home at $171,000," Lopez said. "I had just put in a brand new kitchen worth over $20,000."

He said he complained to his credit union and they talked with the appraiser, who then came back with an amended appraisal of $188,000.

"This still caused problems for my refinancing," said Lopez, who wound up paying an extra $1,600 to close on his new loan as a result _ $1,600 that he won't have available to spend on things such as new windows. "The appraisal process just got me all confused and angry," he said.

In some cases, appraisals are becoming an obstacle for another reason. Wickert tells of a client whose loan process was difficult because there were no comparable sales nearby on which to base an appraisal. The client got the loan, but it wasn't easy.

"There is a significant group of people in America for sure, and Wisconsin to a lesser extent, who can't get a 30-year fixed rate mortgage because they can't get an appraisal," Wickert said.

Although standards are high and lenders are scrutinizing mortgage applications more closely than ever, good deals are available. First-time homebuyers Matt Edlhuber and his fiancee, Erin Schulte, locked in a 5.125 percent interest rate for the house they're buying in Brookfield.

"We got a heck of a deal on a beautiful home in a great neighborhood," Edlhuber said, describing the transaction as beyond smooth.

"It's anything but doom and gloom," said Bill Winkler, senior vice president who oversees mortgage lending for Racine, Wis.-based Johnson Bank. "There's money to be lent."

Whatever higher prices may be involved, they are only fractions of a percent of historically low interest rates, Winkler said, and potential buyers _ including first-time buyers _ should not be intimidated by the mortgage landscape.

It's a lender's job to guide them through the process, Winkler added.

Some real estate agents argue that too much negative news is holding the housing market back more than restrictions on mortgages. Most people who want a house can get financing for one, especially using mortgage options including Federal Housing Authority loans, real estate pros say.

"With a 620 credit score, you can buy a house with 3.5 percent down at 5.5 percent (interest)," said Jim Bucher, a broker at The Agency Real Estate in Germantown.

Dan Lee, vice president of First Weber Group in Madison, said he has heard frustration from consumers over the mortgage finance process.

Still, "Mortgage money is readily available," Lee said. "The key thing is you have to have confidence in your lender _ that they can get you into that property."

Meanwhile, Edlhuber and Schulte are preparing to move into their first house next month. "We're really excited to get in there," Edlhuber said. "We're ecstatic. I've been telling people it's a half-acre lot and it has 10 acres of wallpaper we have to take down."

___

© 2009, Milwaukee Journal Sentinel.

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

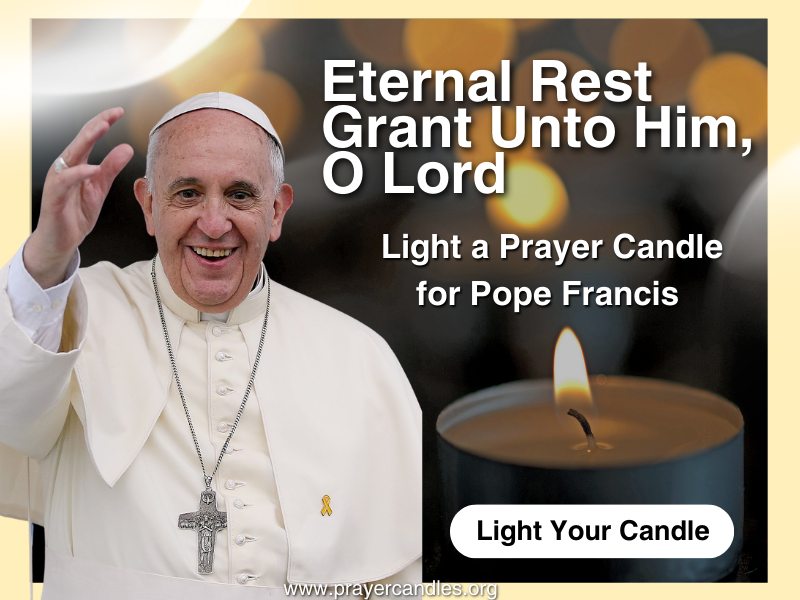

Novena for Pope Francis | FREE PDF Download

-

- Stations of the Cross

- Easter / Lent

- 5 Lenten Prayers

- Ash Wednesday

- Living Lent

- 7 Morning Prayers

- Mysteries of the Rosary

- Litany of the Bl. Virgin Mary

- Popular Saints

- Popular Prayers

- Female Saints

- Saint Feast Days by Month

- Pray the Rosary

Pope Francis’ Final Message to Young People

Pope Francis’ Final Journey Through Rome: A Farewell Full of Symbols and Grace

Hagia Sophia: The 1,600-Year-Old Megastructure Where Heaven and Earth Still Meet

Daily Catholic

Daily Readings for Tuesday, April 29, 2025

Daily Readings for Tuesday, April 29, 2025 St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025

St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025 Prayer for the Dead # 3: Prayer of the Day for Tuesday, April 29, 2025

Prayer for the Dead # 3: Prayer of the Day for Tuesday, April 29, 2025 Daily Readings for Monday, April 28, 2025

Daily Readings for Monday, April 28, 2025 St. Peter Chanel: Saint of the Day for Monday, April 28, 2025

St. Peter Chanel: Saint of the Day for Monday, April 28, 2025- Prayer before a Crucifix: Prayer of the Day for Monday, April 28, 2025

![]()

Copyright 2025 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2025 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Tuesday, April 29, 2025

Daily Readings for Tuesday, April 29, 2025 St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025

St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025 Prayer for the Dead # 3: Prayer of the Day for Tuesday, April 29, 2025

Prayer for the Dead # 3: Prayer of the Day for Tuesday, April 29, 2025 St. Peter Chanel: Saint of the Day for Monday, April 28, 2025

St. Peter Chanel: Saint of the Day for Monday, April 28, 2025