We ask you, urgently: don't scroll past this

Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you.Help Now >

Homeowners refinance at lower mortgage rates

FREE Catholic Classes

McClatchy Newspapers (MCT) - When California state employee Tim McManus peers into the future, he sees 4.5 percent interest.

Highlights

McClatchy Newspapers (www.mctdirect.com)

1/29/2009 (1 decade ago)

Published in Home & Food

"I'm hoping it will go down more. One more drop," says the Sacramento homeowner with a first mortgage at 6 percent and a second at 7.75 percent.

Sacramento's Debbie Fernandez has already locked in at 4.875 percent. That will knock $300 a month off payments for a house she bought in Houston in October. The rate then was 6.25 percent.

But Fernandez, a nurse, is still shopping.

"I hope we can do better."

Roseville, Calif., tech worker Robert Gage is also waiting for the right moment to refinance.

"I can get 4.5 percent for two points," he said. "I'm hoping for 4.75 percent with no points. That's what my goal is."

As 2009 opens, the "refi" chase is on in neighborhoods across the country.

This new suburban sport was launched by mortgage rates that in recent weeks have fallen to lows not seen in almost four decades. Thirty-year fixed rates are suddenly floating in a zone of 5 percent and below _ before fees _ bringing a rush of curiosity and applications, area mortgage brokers, bankers and credit unions say.

It's still not clear if lenders will be as willing to play the game as borrowers. Tightened credit rules, diminishing home values and other economic factors will have a big effect on how many actual refinancings take place.

But the flood of interest is already stressing an industry that has been greatly downsized over the last two years. Nationally, it could be overwhelmed by a deluge of refinancings, said Jim Paterson, partner and broker at Gold River, Calif.-based Mortgage Consultants Group.

"There will be a period when rates drop, a true drop in rates, when it will take longer to get a loan," he said. "It will add two weeks to the process."

The catalyst was Federal Reserve action to buy $600 billion in mortgage debt from government mortgage giants Freddie Mac and Fannie Mae, analysts say. The government intervention aims to make mortgage funds cheaper and more plentiful to help revive the nation's battered economy.

"All of our channels, the Internet, call centers and branches are experiencing significant increases in application volume," said Bank of America spokeswoman Jumana Bauwens.

The push is prompting the bank to shift 300 staffers from its home equity operations to mortgage lending, she said.

(EDITORS: BEGIN OPTIONAL TRIM)

Tri Counties Bank in Chico, Calif., is also seeing "a big pickup in refinancing," said Chief Executive Officer Rick Smith. "As these rates have hit sub 5 (percent), everyone seems to want to come in."

Yet for all the reported frenzy, it's still too early to tell if there is _ or will be _ a 2003-like refinance "boom," said Terry Halleck, president and chief executive of Sacramento-based The Golden 1 Credit Union.

"The past couple of weeks, applications have gone up about 300 percent from a year ago. It's huge. The real question is whether people will complete the loan or are just rate-shopping," she said.

The lack yet of a real boom is partly because many homeowners still believe rates may go lower as the economy weakens. And unlike 2003, many borrowers won't qualify for today's tightened credit rules.

"I had to jump through every hurdle on my loan," said Fernandez, who is moving back to Houston. "They're really scrutinizing people."

Other owners also lack adequate home equity to refinance. And today's lower rates only apply to loans under a certain amount.

But so many homeowners are browsing, Halleck said, that Golden 1 is starting an application fee "to filter out the people who aren't serious."

That's not the only problem for lenders in a volatile rate environment. Paterson said lenders are also seeing a rash of people "breaking" or walking away from their rate locks as a better rate comes along.

That can cost a lender $800 in "hedging" costs on a $200,000 loan, he said. Halleck said Golden 1 doesn't generally allow people to break their locks because of the cost.

(END OPTIONAL TRIM)

"The likelihood is that low mortgage rates are not a flash in the pan. They will be with us for much of 2009 as the Federal Reserve pumps money into the mortgage market over a period of time rather than all at once," said Greg McBride, a senior financial analyst at financial Web site Bankrate.com.

For households that qualify, this is the upside of the worst financial scare since the Great Depression. Many will shed thousands of dollars in long-range interest and free up personal spending money.

Sacramentans Scott and Marika Rose said two recent refinancings erased nearly $200,000 in interest from their original 30-year loan. The pair first refinanced to a 5.37 percent 15-year loan, then to another at 4.37 percent.

But for households that need most to refinance _ those that owe more than their homes are worth _ this is another downside. Almost nine in 10 homeowners of ZIP code 95742 in Rancho Cordova, Calif., fit into that category, said Irvine, Calif.-based First American CoreLogic.

That's because the ZIP code consists almost entirely of new homes sold and financed at near-market highs. Falling values have erased their equity.

Elsewhere, thousands spent part of their home equity gains during the boom. All are now "under water," industry shorthand for owing too much to refinance. Analysts call the condition a major contributor to the state's foreclosure crisis.

McManus, who bought his home in 2003, worries its value might slide to the point of no options before he gets a hoped-for 4.5 percent.

"I'm right on the fence," he said. But McManus also said his longtime mortgage broker "told me to wait. That the rates will probably get better."

(EDITORS: STORY CAN END HERE)

In Roseville, Gage said he still has plenty of equity in the house he bought in 2005 after moving from San Jose. He plowed top-of-the market Bay Area equity into his new home.

"My plan is to take out $30,000 to pay off my car loan," he said. "I have equity in the house. There was no way to tap it until they lowered the rates. "

While Gage aims for 4.75 percent with no points, what he's really hoping for is 4.5 percent.

"If that were to happen I think the cavalry would come home for that. You would see everybody refinancing."

That's still to be seen, said Auburn, Calif.-based real estate appraiser John Ashworth. In the meantime, Ashworth notices the new business "a little mini refi boom" is bringing his way.

"I went from a few or no refis, or sparse refis, in the last half of 2008 to almost daily or several a week," he said. It's starting to compete, he said, with his foreclosure work.

___

© 2009, The Sacramento Bee (Sacramento, Calif.).

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

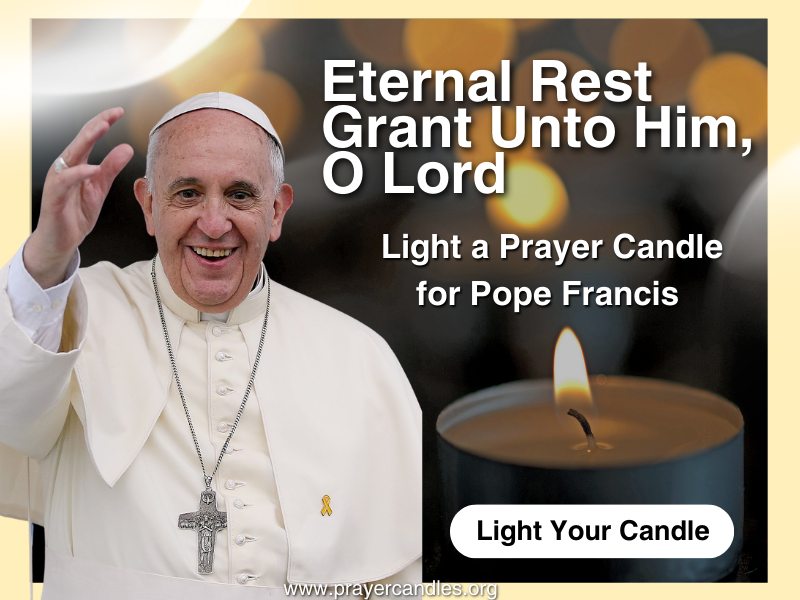

Novena for Pope Francis | FREE PDF Download

-

- Easter / Lent

- Ascension Day

- 7 Morning Prayers

- Mysteries of the Rosary

- Litany of the Bl. Virgin Mary

- Popular Saints

- Popular Prayers

- Female Saints

- Saint Feast Days by Month

- Stations of the Cross

- St. Francis of Assisi

- St. Michael the Archangel

- The Apostles' Creed

- Unfailing Prayer to St. Anthony

- Pray the Rosary

St. Catherine of Siena: A Fearless Voice for Christ and the Church

Conclave to Open with Most International College of Cardinals in Church History

A Symbol of Faith, Not Fashion: Cross Necklaces Find Renewed Meaning Among Young Catholics and Public Leaders

Daily Catholic

Daily Readings for Wednesday, April 30, 2025

Daily Readings for Wednesday, April 30, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025 Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025

Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025 Daily Readings for Tuesday, April 29, 2025

Daily Readings for Tuesday, April 29, 2025 St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025

St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025- Prayer for the Dead # 3: Prayer of the Day for Tuesday, April 29, 2025

![]()

Copyright 2025 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2025 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Wednesday, April 30, 2025

Daily Readings for Wednesday, April 30, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025 Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025

Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025 St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025

St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025