We ask you, urgently: don't scroll past this

Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you.Help Now >

California cities fining banks that allow foreclosed properties to languish

FREE Catholic Classes

McClatchy Newspapers (MCT) - The scene is familiar in neighborhoods throughout the Valley: A dead lawn, debris in front and a murky swimming pool in back, sure signs of a foreclosed home.

Highlights

McClatchy Newspapers (www.mctdirect.com)

10/13/2008 (1 decade ago)

Published in Home & Food

To prevent eyesores, some cities are taking steps to hold lenders responsible for maintaining foreclosed properties.

Homes that are not kept up "affect both the quality of life and the economic state of a neighborhood," said Brian Calhoun, a Fresno, Calif., City Council member.

A California state Senate bill passed in July allows cities to fine owners of neglected foreclosure properties up to $1,000 a day.

Some cities have adopted ordinances requiring lenders to pay fees to register foreclosed properties and authorizing fines or liens if yards and pools aren't maintained.

Registration allows cities to keep track of who is responsible for a property's upkeep, officials said.

"In the foreclosure process, it's very difficult to know who owns the property," said Luis Patlan, Kerman, Calif.'s director of planning and development services.

Fresno city officials are working on an ordinance that would strengthen city policies to oversee and authorize penalties on abandoned and foreclosed properties. The proposal does not call for a fee to register properties, however.

The ordinance is expected to go before the council within the next few weeks. Officials say the city has about 2,600 foreclosed homes.

Making lenders _ who become the property owners after foreclosure _ face financial penalties is a good way to make them take responsibility for the problem, Calhoun said.

"We've been doing a lot of carrots, now we need to do the stick," he said.

Some other local cities have already adopted laws on foreclosed homes.

The Selma, Calif., City Council approved an ordinance in August requiring banks and lending agencies to register and pay $200 annually for each home they own through foreclosure.

The companies also must maintain yards and pools, said D-B Heusser, Selma's city manager. If they don't, the city will hire someone to do the work and bill the lender. An unpaid bill would be applied as a lien against the property, and the lien would have to be paid off before the home could be resold, he said.

Fines imposed in Selma could reach $1,000 a day, said Michael Gaston, the city's community development director.

The ordinance requires the city to notify a lender if a property falls into disrepair. The owner has 14 days to improve the property's condition. Thus far, one owner has been given notice, Gaston said.

Selma has about 65 foreclosed houses, fewer than 1 percent of the city's homes, he said.

In Kerman, lending and mortgage companies must pay $50 annually to register home foreclosures, Patlan said.

The owners of the properties must remove or replace dead landscaping and maintain the yards, he said. The companies also must secure the doors and windows to prevent trespassers and vandalism.

Lending and mortgage firms are subject to daily fines that could reach $850 a day.

"The goal is to get their attention that the city is serious about the issue and we want them to maintain the properties to neighborhood standards," Patlan said.

Kerman officials have identified about 55 foreclosed houses, or about 2 percent of the city's residences, he said.

Water service is usually turned off when homes are abandoned, but city officials are working with the lending companies to have water restored so lawns and yards can be maintained, said Ron Manfredi, Kerman's city manager.

Neither Selma nor Kerman has yet levied fines under the new laws.

Kerman's ordinance is modeled after one that Chula Vista, Calif., a city of 235,000 south of San Diego, implemented about a year ago.

The ordinance has reduced the number of unkempt houses, said Doug Leeper, Chula Vista's code enforcement manager.

"We still have problems, but not nearly as many as we would have without this ordinance," he said.

Fines in Chula Vista range from $100 to $1,000 a day, "depending on the severity of the problem," Leeper said.

"We just keep escalating the penalty until we get their attention," he said. "My goal was not to be their property manager. They speak one language _ money."

Banks and lending firms also must pay past-due water bills to restore water service, Leeper said.

"They howled at first. Several understood. They've come around," he said.

In the first 10 months, Chula Vista officials issued more than $500,000 in fines and penalties, he said. Unpaid fines are applied as a lien on the property.

Don Scordino, president of the Fresno Association of Realtors, said his organization has voiced concerns about the proposed Fresno ordinance.

He said his association wants the ordinance to be "transaction-friendly" so liens do not hold up sales of foreclosed homes, which have picked up significantly this year compared with 2007. Buyers should not have to pay "for the sins of past owners" whose homes were foreclosed, he said.

(EDITORS: STORY CAN END HERE)

"Our association is trying to help find a workable process," Scordino said.

Selma resident Teresa Correa can't wait for the city's ordinance to start having an effect.

Correa lives across the street from a foreclosed home with a dead lawn. She and her family recently considered selling their home just west of Highway 99, where they have lived for 16 years, but the adjacent run-down foreclosed property is devaluing their home.

A real estate agent told them, "Your home is OK, but look at what's across the street. Nobody is going to want to buy your home," Correa said.

Correa said she is glad that city officials are doing something about keeping unoccupied residences from becoming eyesores.

The foreclosed home stands out in Correa's neighborhood, she said.

"It catches your eye right away," she said.

___

© 2008, The Fresno Bee (Fresno, Calif.).

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

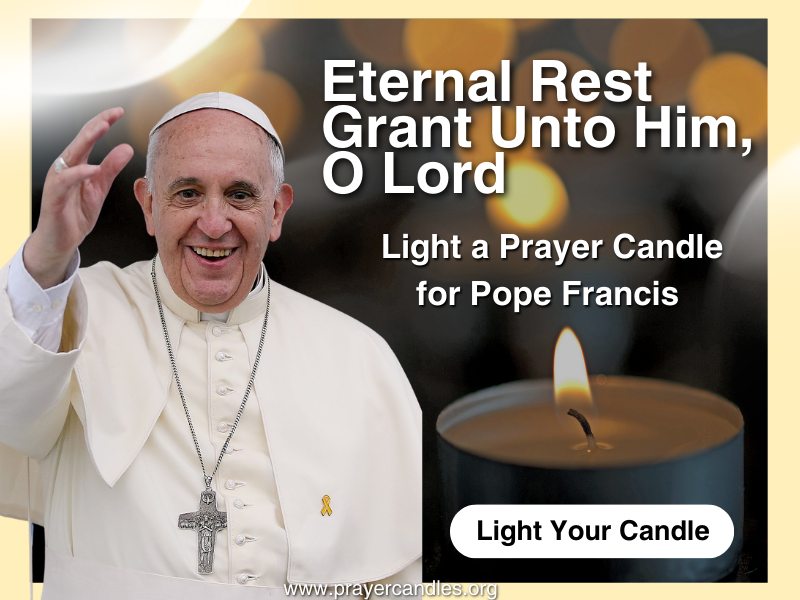

Novena for Pope Francis | FREE PDF Download

-

- Easter / Lent

- Ascension Day

- 7 Morning Prayers

- Mysteries of the Rosary

- Litany of the Bl. Virgin Mary

- Popular Saints

- Popular Prayers

- Female Saints

- Saint Feast Days by Month

- Stations of the Cross

- St. Francis of Assisi

- St. Michael the Archangel

- The Apostles' Creed

- Unfailing Prayer to St. Anthony

- Pray the Rosary

St. Catherine of Siena: A Fearless Voice for Christ and the Church

Conclave to Open with Most International College of Cardinals in Church History

A Symbol of Faith, Not Fashion: Cross Necklaces Find Renewed Meaning Among Young Catholics and Public Leaders

Daily Catholic

Daily Readings for Thursday, May 01, 2025

Daily Readings for Thursday, May 01, 2025 St. Marculf: Saint of the Day for Thursday, May 01, 2025

St. Marculf: Saint of the Day for Thursday, May 01, 2025 To Saint Peregrine: Prayer of the Day for Thursday, May 01, 2025

To Saint Peregrine: Prayer of the Day for Thursday, May 01, 2025 Daily Readings for Wednesday, April 30, 2025

Daily Readings for Wednesday, April 30, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025- Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025

![]()

Copyright 2025 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2025 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Thursday, May 01, 2025

Daily Readings for Thursday, May 01, 2025 St. Marculf: Saint of the Day for Thursday, May 01, 2025

St. Marculf: Saint of the Day for Thursday, May 01, 2025 To Saint Peregrine: Prayer of the Day for Thursday, May 01, 2025

To Saint Peregrine: Prayer of the Day for Thursday, May 01, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025