Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources—essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you. Help Now >

Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources—essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you. Help Now >

Surviving `Finances After Separation'

FREE Catholic Classes

VANCOUVER, Canada (CCN/B.C. Catholic) - "Til Debt Do Us Part," a television program available on the Life Network, says it all: money troubles are the most common cause of marriage breakdown.

Highlights

Canadian Catholic News (www.cathnews.net/)

10/26/2006 (1 decade ago)

Published in Marriage & Family

Few things are more stressful than separation and divorce, says Douglas Welbanks, a Vancouver debt management and former director of the B.C. Debtor Assistance and Debt Collection Agency. In his book, Finances After Separation, A Guide to Financial Renewal and Success for Separated Families (Chateau Lane Publishing), Welbanks applies 30 years of experience to helping couples avoid turning a split-up into a costly and emotionally-wrenching battle. Many people, he says, think that divorce will solve their problems, including the money ones, but in fact, the process usually means trading in old money woes for new ones. The Ottawa-based Vanier Institute has found that the number of bankruptcies in Canada is on the rise. Since the mid-1990s, the real purchasing power of families has badly deteriorated. Most Canadians seem to have decided they don't believe in rainy days, so it shouldn't come as a surprise that Statistics Canada reported that 2005 was the first year in which across-the-board consumer spending exceeded income: bad news for struggling families. The Credit Counseling Service of Toronto is seeing a significant increase in the number of its clients, Michael Swan reported in the Catholic Register. "They are seeing couples come in on the edge of divorce because they're drowning in debt. There's a price being paid by children and couples that has a lot to do with low, low financing on approved credit." Welbanks agrees. "This easy-credit, consumer-oriented, pay much, much later society is one in which more and more marriages founder because of their deteriorating financial picture. People are under the illusion that, once they have actually decided to separate, an easy-to-follow pattern falls into place. However pressure from creditors actually pushes them into attempting to resolve property issues first and trying to deal with the more `family-like' matters such as child support and custody later." People in their 30s, 40s and 50s are increasingly called upon to financially care for elderly parents, even when their adult children might still live at home or be dependent in other ways, Welbanks explains. Other factors contributing to Canadians' debt load include high housing costs, the proliferation of low-wage jobs, and the way student loans are handled, a pet peeve of Welbanks. In addition, he says, we all seem to live under a veil of secrecy when it comes to money troubles. "Talking about sex in public is more acceptable today than talking about money! Money makes people angry and makes them anxious. When money is introduced into any conversation, the climate changes and becomes guarded, argumentative, or characterized by a high degree of defensiveness." Sprinkled throughout Welbanks' easy-to-read book are case studies of estranged couples who have fallen into post-divorce financial pits. Financial troubles, in addition to causing marriage breakdown, often prevent separated and divorced people from moving on with their lives, so anyone even thinking about leaving a spouse should read and heed his advice, which includes calling a pastor or an agency such as Catholic Family Services to deal with serious relationship and family problems. A doctor's visit is number one on Welbanks' Ten First Steps After Separation because separating couples have high stress levels and are frequently subject to clinical depression. Check on the laws and rules which govern separation, Welbanks suggests, keeping in mind that financial disclosure can be intimidating but is essential for both parties. Thoroughly investigate lawyer referral services, mediation, and collaborative ways to handle child-support issues, and be aware that federal guidelines set mandatory amounts of child support. Welbanks lists some positive steps to take, such as reviewing your employee benefits and, if they allow it, taking employment leave to deal with the new pressures; talking to employers about reduced work schedules; and seeking counseling and family resources in your community as well as professional help for dispute resolution and mediation rather than going to court. Mediation, says Welbanks, in the case of spouses who will co-operate, is often available through government agencies and provincial family courts. If there have been issues of abuse: physical, emotional, mental, or financial, make sure they cease, says Welbanks, either through obtaining a restraining order or another means. If it is necessary, he cautions, shut down irresponsible credit usage which can include credit cards, credit lines, and bank accounts. Know the court options in case of non-co-operation or gridlock between the spouses. Courts are there to protect the rights of children, says Welbanks. Finally, he adds, "Learn all you can. Find out about the separation/divorce process, custody, child and spousal support, and how division of property works." Welbanks's book is a great place to start a review of all that is involved in the separation process. A handy resources section is filled with contact information on agencies including Legal Aid and family organizations. Information on Welbanks's book, which is priced at $22.95, is available through his Web site, www.financesafterseparation.com.

---

Republished by Catholic Online with permission of the Canadian Catholic News Service.

- - -Among CCN governing members is the Western Catholic Reporter (http://www.wrc.ab.ca), serving Catholics in Alberta and published by the Archdiocese of Edmonton.

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

-

-

Mysteries of the Rosary

-

St. Faustina Kowalska

-

Litany of the Blessed Virgin Mary

-

Saint of the Day for Wednesday, Oct 4th, 2023

-

Popular Saints

-

St. Francis of Assisi

-

Bible

-

Female / Women Saints

-

7 Morning Prayers you need to get your day started with God

-

Litany of the Blessed Virgin Mary

Introducing "Journey with the Messiah" - A Revolutionary Way to Experience the Bible

-

Catholic Response to Devastating Los Angeles Wildfires

-

Federal Court Blocks Biden Administration's Gender Identity Rule

-

A Future for Life: Introducing the Winners of the Priests for Life Pro-Life Essay Contest

-

Reflections on Pope Francis' 2025 World Day of Peace message

Daily Catholic

Daily Readings for Saturday, January 11, 2025

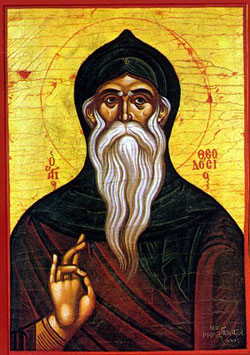

Daily Readings for Saturday, January 11, 2025 St. Theodosius the Cenobiarch: Saint of the Day for Saturday, January 11, 2025

St. Theodosius the Cenobiarch: Saint of the Day for Saturday, January 11, 2025 Prayer for a Blessing on the New Year: Prayer of the Day for Tuesday, December 31, 2024

Prayer for a Blessing on the New Year: Prayer of the Day for Tuesday, December 31, 2024- Daily Readings for Friday, January 10, 2025

- St. William of Bourges: Saint of the Day for Friday, January 10, 2025

- St. Theresa of the Child Jesus: Prayer of the Day for Monday, December 30, 2024

![]()

Copyright 2024 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2024 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Saturday, January 11, 2025

Daily Readings for Saturday, January 11, 2025 St. Theodosius the Cenobiarch: Saint of the Day for Saturday, January 11, 2025

St. Theodosius the Cenobiarch: Saint of the Day for Saturday, January 11, 2025 Prayer for a Blessing on the New Year: Prayer of the Day for Tuesday, December 31, 2024

Prayer for a Blessing on the New Year: Prayer of the Day for Tuesday, December 31, 2024