Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources—essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you. Help Now >

Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources—essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you. Help Now >

How can newlyweds become homeowners?

FREE Catholic Classes

Washington, D.C. (CNS) - Get married, buy a home, settle down and raise children. So goes the American dream. Approximately 2.3 million couples get married annually in the United States. Many start thinking about purchasing a home within a year or two.

Highlights

Catholic News Service (www.catholicnews.com)

8/3/2006 (1 decade ago)

Published in Marriage & Family

The U.S. Census Bureau reports that in 2000, 66 percent of the nation's population owned their own dwellings -- whether a detached house, mobile home or apartment. However, homeownership by people under 35 - covering most newlywed couples - averaged only 39 percent in 2000, ranging from a low of 27 percent in California and New York, to a high of almost 50 percent in West Virginia and Michigan. Forbes magazine advises prospective home buyers to take care of two other things first: Pay off other debts, and establish an emergency fund that could cover expenses for at least three months. The magazine also advises newlyweds that before investing in a home they should establish a retirement fund and consider term life insurance for protection in case of tragedy. The June 2004 issue of Forbes recommended that total house payments, including taxes and insurance, not exceed 25 percent of take-home pay, 15 percent if people are not sure of job security. Lenders, however, are willing to loan more. This is a very good time for first-time home buyers, says Doug Winter, area manager of Wells Fargo Home Mortgage in Minneapolis, Minn. At the start of 2005, interest rates were as low as 5.62 at a 30-year fixed rate. And many programs have been established to help first-time buyers, says Winter. This was the case for Jeff and Jennifer Bliss, both 33, of Tucson, Ariz. She is a teacher, he is an engineer. They'd been married about a year, Jennifer Bliss says, when their first child was born. Their savings for a home then took a back seat. She looked on the Internet and found the "Teacher Next Door" program. Under the program they found a Housing and Urban Development home no one else was bidding on. They purchased the home at 50 percent of the cost, making no down payment and paying only closing costs. They would need to live in the house at least three years. Bliss says they could not have afforded to own a home were it not for this program. Winter strongly suggests that couples get "pre-approved" for financing before shopping for a home. In the pre-approval process, prospective homebuyers talk with a bank (or a community agency designed to assist home ownership) about available financing avenues. A pre-approval meeting tells a couple how much they are eligible to borrow and what loans are available to them. Often the key is getting an affordable down payment and eliminating the mortgage insurance premium, says Winter. Wells Fargo has an 80/20 program that takes 80 percent of the sales price, adds a second mortgage of 20 percent of the sales price, eliminates the mortgage insurance and saves the down payment. FHA loans are great when it comes to using gifts from parents or putting the cash received at a couple's wedding as a down payment. HUD approved a bridal-registry program in 1996 allowing family and friends to give money as a wedding gift to be used toward the down payment of a couple's first home. Many cities and counties also offer assistance programs called bond loans. They are based on income, focusing on low- and middle-income owners. Wells Fargo has a regional Community Development Mortgage Program that allows 2 percent down and does not require mortgage insurance. (On a $150,000 home with 5 percent down, the mortgage insurance is $92.63 a month). Winter says programs like the "Teacher Next Door" offer incentives for teachers to live in the area where they work in exchange for a lower down payment. Similar programs often are offered for police, firefighters, nurses and other professions. With careful planning and by exploring options available, the American dream of owning a home is possible. - - - Zapor is a free-lance writer in California.

---

Copyright (c) 2007 Catholic News Service/U.S. Conference of Catholic Bishops

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

-

-

Mysteries of the Rosary

-

St. Faustina Kowalska

-

Litany of the Blessed Virgin Mary

-

Saint of the Day for Wednesday, Oct 4th, 2023

-

Popular Saints

-

St. Francis of Assisi

-

Bible

-

Female / Women Saints

-

7 Morning Prayers you need to get your day started with God

-

Litany of the Blessed Virgin Mary

Introducing "Journey with the Messiah" - A Revolutionary Way to Experience the Bible

-

Catholic Response to Devastating Los Angeles Wildfires

-

Federal Court Blocks Biden Administration's Gender Identity Rule

-

A Future for Life: Introducing the Winners of the Priests for Life Pro-Life Essay Contest

-

Reflections on Pope Francis' 2025 World Day of Peace message

Daily Catholic

Daily Readings for Saturday, January 11, 2025

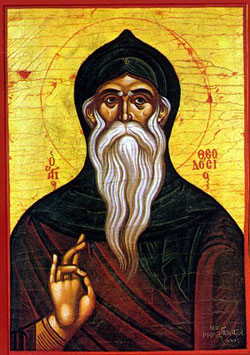

Daily Readings for Saturday, January 11, 2025 St. Theodosius the Cenobiarch: Saint of the Day for Saturday, January 11, 2025

St. Theodosius the Cenobiarch: Saint of the Day for Saturday, January 11, 2025 Prayer for a Blessing on the New Year: Prayer of the Day for Tuesday, December 31, 2024

Prayer for a Blessing on the New Year: Prayer of the Day for Tuesday, December 31, 2024- Daily Readings for Friday, January 10, 2025

- St. William of Bourges: Saint of the Day for Friday, January 10, 2025

- St. Theresa of the Child Jesus: Prayer of the Day for Monday, December 30, 2024

![]()

Copyright 2024 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2024 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Saturday, January 11, 2025

Daily Readings for Saturday, January 11, 2025 St. Theodosius the Cenobiarch: Saint of the Day for Saturday, January 11, 2025

St. Theodosius the Cenobiarch: Saint of the Day for Saturday, January 11, 2025 Prayer for a Blessing on the New Year: Prayer of the Day for Tuesday, December 31, 2024

Prayer for a Blessing on the New Year: Prayer of the Day for Tuesday, December 31, 2024