We ask you, urgently: don’t scroll past this

Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources—essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you.Help Now >

Is your portfolio politically slanted?

FREE Catholic Classes

(The Christian Science Monitor) - Do you know the political slant of your portfolio? Every election cycle, U.S. businesses pour hundreds of millions of dollars into campaigns, parties, and politically affiliated groups. Some of that money is reported, some isn't. Now a movement to get corporations to disclose voluntarily their political contributions is gaining ground. Recently, the Monitor's Laurent Belsie interviewed Bruce Freed, executive director of The Center for Political Accountability, a nonprofit, nonpartisan group based in Washington. Here are edited excerpts of their conversation:

Highlights

The Christian Science Monitor (www.csmonitor.com)

3/7/2008 (1 decade ago)

Published in Living Faith

B>Q: Campaign spending for all offices could top $5 billion this year. How much of that comes from corporations?

Freed: I think a significant amount is coming from businesses. It's difficult, though, to come up with a precise figure because of the absence of disclosure.

Q: It seems like a tangled web.

Freed: Money that's given through company political action committees is easy to track because that's reported to the Federal Election Commission. Money that would be given at the state level, that could include corporate money, that can be tracked easily if a state has good disclosure requirements. The problem is that disclosure at the state level is spotty. And when companies give corporate funds - that would be soft money given to 527s and those types of groups - that's reported only by the recipient, not by the contributor. But then you have companies giving a great deal of money through trade associations and through other tax-exempt organizations. Those would be 501(c)(4)s. There's no disclosure of that.

Q: What are 501(c)(4)s?

Freed: [They] are known as social-welfare organizations. But they're a nonprofit. There are certain restrictions on what they can spend money on. But the fact is they can be used to engage in political activity up to a certain line. And ... they can engage in significant political activity.

Q: Can investors check the political spending of the companies they own?

Freed: It's very difficult.... In those cases where a company has agreed to [disclose political spending] and is reporting, an investor can find out. But that's just 34 companies of ... the S&P 200. So it's a limited number of companies.

Q: Your group is pushing companies to disclose political contributions. How is that going?

Freed: The effort is moving along very successfully.... We're now talking with at least 10 companies. I expect that by the end of the 2008 proxy season a quarter of the companies in the S&P 200 list will have agreed to disclosure and broad oversight of their political spending. And a growing number of those companies, by the way, are agreeing to disclosure not only of the soft money but of their payments to trade associations and other tax-exempt organizations that are used for political purposes.

Q: You have asked for voluntary disclosure from the U.S. Chamber of Commerce. Why?

Freed: The Chamber of Commerce is really the premier business trade association in the United States. They really have been the most active politically.... Companies in other trade associations have routed their money through the chamber. The chamber just announced ... that it planned to spend more than $60 million on the 2008 elections.

Q: So even if all corporations disclosed their spending, we still wouldn't know where money routed through trade associations was going.

Freed: It's a black box. And it's a black box that runs into the hundreds of millions of dollars.

Q: While most people seem to agree that transparency is a good thing, some say it's not enough, because violations happen despite disclosure.

Freed: Accountability goes hand in hand with disclosure because accountability means that top management and directors really look at what the company is doing, what the impact is on the company, how it may affect risk, how it may affect shareholder value.

Q: How does it affect shareholder value?

Freed: You could have political spending by a company that would basically aid and abet various regulatory abuses. When you had the collapse of quite a few companies at the turn of the last century - your Enrons, your WorldComs, your Global Crossings - political money was very important there because companies were using that either to buy lax regulation or no regulation.... Then you have the problem of reputation.

Q: Is there an incident that stands out?

Freed: You have the case of Merck that gave money to a candidate named Samac Richardson. This was in Mississippi in 2004. He was running for the State Supreme Court.... Samac Richardson was a strong supporter of tort reform, which many companies want. But Samac Richardson was also running a campaign that was against gay rights, against abortion, and getting involved in controversial social issues that many companies shy away from. So that was very embarrassing for many companies.

Q: Why don't companies keep a closer eye on their political spending?

Freed: Companies up to now have viewed their political spending as immaterial when compared with other expenditures that they make.... But what we are finding is that companies are now beginning to recognize that there are very material consequences for expenditures that they had in the past viewed as immaterial. And as we press directors to start paying closer attention to corporate political spending, as questions are raised in our reports and by the media and by other groups about companies' political spending, that's beginning to change and companies are beginning to realize they have to pay attention to this.

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

-

-

Mysteries of the Rosary

-

St. Faustina Kowalska

-

Litany of the Blessed Virgin Mary

-

Saint of the Day for Wednesday, Oct 4th, 2023

-

Popular Saints

-

St. Francis of Assisi

-

Bible

-

Female / Women Saints

-

7 Morning Prayers you need to get your day started with God

-

Litany of the Blessed Virgin Mary

5 Biblical Warnings We All Must Heed

-

WHAT WILL IT TAKE? | Bishop Strickland Calls Out Silent Bishops in Strong Public Letter

-

Giants of the Fallen: Unveiling the Mystery of the Nephilim from a Catholic Perspective

-

Ancient Wisdom, Modern Choices: How Ecclesiastes 10:2 Illuminates Today's Political Divide

-

How Do We Know Truth? A Catholic Perspective

Daily Catholic

Daily Readings for Monday, November 18, 2024

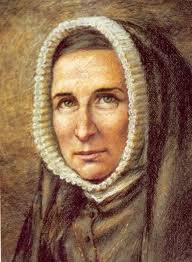

Daily Readings for Monday, November 18, 2024 St. Rose Philippine Duchesne: Saint of the Day for Monday, November 18, 2024

St. Rose Philippine Duchesne: Saint of the Day for Monday, November 18, 2024 Bless Me, Heavenly Father.: Prayer of the Day for Monday, November 18, 2024

Bless Me, Heavenly Father.: Prayer of the Day for Monday, November 18, 2024- Daily Readings for Sunday, November 17, 2024

- St. Elizabeth of Hungary: Saint of the Day for Sunday, November 17, 2024

- Prayer to Saint Anthony of Padua, Performer of Miracles: Prayer of the Day for Sunday, November 17, 2024

![]()

Copyright 2024 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2024 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Monday, November 18, 2024

Daily Readings for Monday, November 18, 2024 St. Rose Philippine Duchesne: Saint of the Day for Monday, November 18, 2024

St. Rose Philippine Duchesne: Saint of the Day for Monday, November 18, 2024 Bless Me, Heavenly Father.: Prayer of the Day for Monday, November 18, 2024

Bless Me, Heavenly Father.: Prayer of the Day for Monday, November 18, 2024