Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you. Help Now >

Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you. Help Now >

Why it's now impossible to pay enough taxes to feed the government

FREE Catholic Classes

The U.S. government has brought in an impressive haul of tax revenue for the first five months of fiscal 2016, but despite the size of the take, it's still running a massive deficit.

Highlights

CALIFORNIA NETWORK (https://www.youtube.com/c/californianetwork)

3/11/2016 (9 years ago)

Published in Business & Economics

Keywords: Business, economics, government, taxes, deficit, spending

LOS ANGELES, CA (California Network) - The Treasury Department has brought in nearly 1.25 trillion dollars from American workers since Oct. 1, the start of the 2016 fiscal year. That is approximately $8,263 per working American. How much money have you brought home in that time?

In addition to spending that $1.25 trillion, the government has also run a deficit of nearly $200 billion in that same time.

Deficit spending is essentially using a national credit card to cover regular expenses, and that debt must be repaid with interest. In general, the U.S. government spends over $1.6 trillion per month.

Most of the government's revenue taken to date comes from the individual income tax, which brought in nearly $600 billion. Social Security and other payroll taxes brought in about $428 billion.

The heart of the problem is that many Americans pay no taxes and our government willingly spends more than it takes in. Programs that put Americans to work, as well as eliminating wasteful spending are essential if the United States is to reverse its problem with debt.

But even this is likely impossible. There are too few working age Americans with too few working hours available to satiate the government's appetite for spending. Even if every American citizen worked and paid taxes, there would just be new spending on top of old spending, creating even more debt. We're in an economic system that thrives on debt and we cannot break even, we cannot even quit.

Debt eventually snowballs and can become impossible to repay. The repudiation of debt, or the attempt to repay a snowballing debt in the face of bankruptcy can has substantial social consequences, as we've seen in Greece the past few years. Despite selling government assets and deep cuts in social spending, Greece cannot repay its debts, which remain out of control.

Since many banks rely on debt payments to remain solvent, a missed payment, or even the threat of a missed payment can throw an entire economy into disarray.

This is our future if we do not reform our tax policies and slash government spending.

--- The California Network is the Next Wave in delivery of information and entertainment on pop culture, social trends, lifestyle, entertainment, news, politics and economics.

We are hyper-focused on one audience, YOU, the connected generation.

JOIN US AS WE REDEFINE AND REVOLUTIONIZE THE EVER-CHANGING MEDIA LANDSCAPE.

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

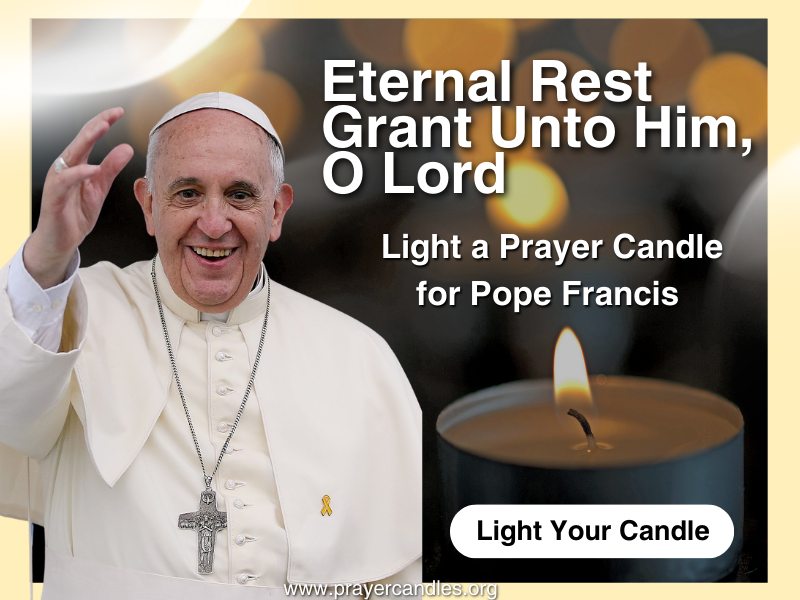

Novena for Pope Francis | FREE PDF Download

-

- Stations of the Cross

- Easter / Lent

- 5 Lenten Prayers

- Ash Wednesday

- Living Lent

- 7 Morning Prayers

- Mysteries of the Rosary

- Litany of the Bl. Virgin Mary

- Popular Saints

- Popular Prayers

- Female Saints

- Saint Feast Days by Month

- Pray the Rosary

College of Cardinals Announces May 7 Start Date for Conclave to Elect New Pope

Trump and Zelensky Hold ‘Very Productive’ Meeting Before Pope Francis’ Funeral, Raising Hopes for Peace

JUDGES, GUNS, AND GANGS: Cartels Are Infiltrating America’s Cities and Courtrooms

Daily Catholic

Daily Readings for Tuesday, April 29, 2025

Daily Readings for Tuesday, April 29, 2025 St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025

St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025 Prayer for the Dead # 3: Prayer of the Day for Tuesday, April 29, 2025

Prayer for the Dead # 3: Prayer of the Day for Tuesday, April 29, 2025 Daily Readings for Monday, April 28, 2025

Daily Readings for Monday, April 28, 2025 St. Peter Chanel: Saint of the Day for Monday, April 28, 2025

St. Peter Chanel: Saint of the Day for Monday, April 28, 2025- Prayer before a Crucifix: Prayer of the Day for Monday, April 28, 2025

![]()

Copyright 2025 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2025 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Tuesday, April 29, 2025

Daily Readings for Tuesday, April 29, 2025 St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025

St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025 Prayer for the Dead # 3: Prayer of the Day for Tuesday, April 29, 2025

Prayer for the Dead # 3: Prayer of the Day for Tuesday, April 29, 2025 St. Peter Chanel: Saint of the Day for Monday, April 28, 2025

St. Peter Chanel: Saint of the Day for Monday, April 28, 2025