Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you. Help Now >

Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you. Help Now >

Parents, as well as children, can use 529 college savings plan

FREE Catholic Classes

The Dallas Morning News (MCT) - Don't think 529 college savings plans are just for young people. Their parents can also use them to save for their own college education.

Highlights

McClatchy Newspapers (www.mctdirect.com)

4/6/2009 (1 decade ago)

Published in Business & Economics

"They are a very good tool for tax-free savings when an adult is thinking about returning to school," said Joseph Hurley, founder of savingforcollege.com, which educates families on how to save for college.

The struggling economy makes this a great time to consider returning to school and improving your skills.

An option that many adults may not be aware of is the ability to change the beneficiary on a 529 account to another family member "in the event the current beneficiary has no qualified use for the money," Hurley said.

"Parents should realize that making contributions to a child's 529 account provides a potential college funding source if they should ever lose their jobs and go back to school themselves."

The 529 college savings plans run by states work much like a 401(k) or an IRA by investing your contributions in mutual funds or similar investments.

The plan offers you several investment options from which to choose. Your account will go up or down in value based on the performance of the option you select. Earnings grow tax-deferred and withdrawals are tax-free when used for qualified post-secondary education costs.

The plans derive their name from Section 529 of the Internal Revenue Code, which created these types of savings plans in 1996.

The plans can be used for adult education at eligible institutions.

"An eligible institution is just about any accredited postsecondary school, including community colleges and many of the privately held online universities," Hurley said. "If an institution is part of the federal student aid system, then it is an eligible institution for purposes of Section 529."

And you don't have to be seeking a degree to save through a 529 plan; you can use a 529 plan to pay for vocational/technical schools.

The 529 plans cover such qualified higher education expenses as tuition, room and board, mandatory fees, along with books and computers (if required).

So if you think that college or vocational courses are in your future, you can set aside funds in a tax-deferred 529 plan, naming yourself as beneficiary, and tap the account tax-free to pay for those courses.

Most 529 savings plans have no state residency requirements, but you should check first.

"You can open accounts in as many of these states as you want, although in most cases there is little reason to have accounts in more than one or two states," Hurley said.

"There hasn't been any recent spike in people buying 529 accounts for themselves," said R.J. DeSilva, spokesman for Texas Comptroller Susan Combs. "It's possible that some adults may start thinking about longer-term planning and using 529s to pay for college for second careers, but it's too early to say if that will happen."

It's certainly another option to consider in this uncertain economy that's forcing all of us to think about what we want to be doing down the road.

___

© 2009, The Dallas Morning News.

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

Novena for Pope Francis | FREE PDF Download

-

- Easter / Lent

- Ascension Day

- 7 Morning Prayers

- Mysteries of the Rosary

- Litany of the Bl. Virgin Mary

- Popular Saints

- Popular Prayers

- Female Saints

- Saint Feast Days by Month

- Stations of the Cross

- St. Francis of Assisi

- St. Michael the Archangel

- The Apostles' Creed

- Unfailing Prayer to St. Anthony

- Pray the Rosary

St. Catherine of Siena: A Fearless Voice for Christ and the Church

Conclave to Open with Most International College of Cardinals in Church History

A Symbol of Faith, Not Fashion: Cross Necklaces Find Renewed Meaning Among Young Catholics and Public Leaders

Daily Catholic

Daily Readings for Wednesday, April 30, 2025

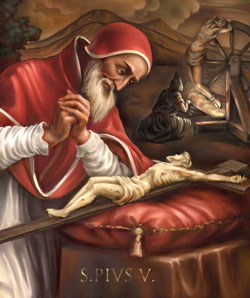

Daily Readings for Wednesday, April 30, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025 Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025

Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025 Daily Readings for Tuesday, April 29, 2025

Daily Readings for Tuesday, April 29, 2025 St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025

St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025- Prayer for the Dead # 3: Prayer of the Day for Tuesday, April 29, 2025

![]()

Copyright 2025 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2025 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Wednesday, April 30, 2025

Daily Readings for Wednesday, April 30, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025 Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025

Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025 St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025

St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025