We ask you, urgently: don't scroll past this

Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you.Help Now >

Do your homework before buying certificates of deposit

FREE Catholic Classes

The Dallas Morning News (MCT) - The case against Texas financier R. Allen Stanford centers on a bank product that's the linchpin of security for safety-conscious consumers _ certificates of deposit.

Highlights

McClatchy Newspapers (www.mctdirect.com)

4/6/2009 (1 decade ago)

Published in Business & Economics

Unfortunately, as consumers have become hypersensitive about the safety of their money, some scammers have latched onto CDs as a way to steal consumers' money.

"There is a move toward conservative investing, and that really is what has propelled the size of the frauds," said Steven Korotash, associate director of the Securities and Exchange Commission's Fort Worth, Texas, regional office.

The SEC has charged Stanford and his Stanford International Bank Ltd. with committing a "massive Ponzi scheme" centering on an $8 billion CD program.

Federal regulators said Stanford attracted investors by touting "consistent, double-digit returns" that "greatly exceeded those offered by commercial banks in the United States."

In a separate case, the SEC obtained a court order in March to halt an alleged $68 million Ponzi scheme that drew hundreds of U.S. investors to buy fictitious CDs through a foreign bank.

The SEC said two U.S. residents misled investors into believing they were putting their money in CDs that would provide returns up to 321 percent higher than legitimate bank-issued CDs.

"The investors weren't greedy folks trying to get rich quick," said Korotash. "They were looking for a conservative investment that would provide a slightly higher rate of return than what was available in the U.S."

The two cases, experts say, highlight the need to do your homework before investing your money. Here's what you can do to keep from getting fooled when buying CDs:

Remember the adage that if it sounds too good to be true, it probably is.

Don't blindly accept that the abnormally high yields being touted come with little or no risk. They do.

In the Stanford case, the SEC said Stanford International Bank sold CDs to investors by "promising improbable and unsubstantiated high interest rates."

"Indeed, SIB claims that its diversified portfolio of investments lost only 1.3 percent in 2008, a time during which the S&P 500 lost 39 percent," SEC officials said.

But, the SEC said, those claims were false.

Verify that the bank issuing a CD is insured by the Federal Deposit Insurance Corp.

"Ask many questions about the CD or the CD-type of product," said John Gannon, senior vice president of investor education at the Financial Industry Regulatory Authority, or FINRA, which oversees the U.S. brokerage industry. "The most important one is, is the issuing bank FDIC-insured?"

U.S. federal deposit insurance guarantees deposits for up to $250,000 per owner on single accounts and up to $250,000 per co-owner on joint accounts.

You can verify whether a bank carries FDIC insurance by going to the agency's Web site or by calling toll-free 1-877-275-3342.

Be careful if the bank issuing the CD is located offshore.

"Once you're outside of the United States, it's less certain what protection you have," Gannon said. "You just have to understand that there is an additional level of risk."

Stanford International Bank is a private international bank in Antigua, the SEC said. The bank's officials told investors that their deposits were safe because Antiguan regulators audited its financial statements, but that wasn't true, SEC officials said in court documents.

The second Ponzi scheme alleged by the SEC involved the sale of fake high-yield CDs by Caribbean Millennium Bank, which is licensed in St. Vincent and the Grenadines.

"The defendants disguised their Ponzi scheme as a legitimate offshore investment and made promises about exuberant returns that were just too good to be true," said Rose Romero, director of the SEC's Fort Worth office.

"This case demonstrates that investors need to be especially cautious when placing money with entities that may be outside the reach of U.S. regulators."

If buying through a deposit broker, make sure you're dealing with a reputable firm.

There's nothing wrong with buying a broker-sold CD, but you have to be educated.

Brokers sometimes can negotiate a higher interest rate on a bank-issued CD because they can bring a large amount of deposits to the bank.

"A deposit broker can be anyone from one person working alone from home to someone affiliated with a major financial services firm," the FDIC said. "There is no federal or state licensing or certification process to become a deposit broker, and the FDIC does not examine, approve or insure deposit brokers."

One of the best ways to check out your broker is to use BrokerCheck, operated by FINRA. Call BrokerCheck's toll-free number at 1-800-289-9999, or go to its Web site to learn whether a broker has had customer complaints filed against him and whether he's been the subject of consumer-initiated pending arbitrations or civil proceedings.

You should find out whether state regulators where you live have taken disciplinary action against a broker.

Additionally, you can check with the Better Business Bureau to see if it has a file on the deposit broker.

Before buying a CD, ask the broker for the name of the bank or savings association where your money is to be deposited. Then verify that the bank is FDIC-insured.

"Bank CDs should be one of the safest investments you could make because of FDIC insurance that backs up the bank's promise to pay you back," said FINRA's Gannon.

___

© 2009, The Dallas Morning News.

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

Novena for Pope Francis | FREE PDF Download

-

- Easter / Lent

- Ascension Day

- 7 Morning Prayers

- Mysteries of the Rosary

- Litany of the Bl. Virgin Mary

- Popular Saints

- Popular Prayers

- Female Saints

- Saint Feast Days by Month

- Stations of the Cross

- St. Francis of Assisi

- St. Michael the Archangel

- The Apostles' Creed

- Unfailing Prayer to St. Anthony

- Pray the Rosary

St. Catherine of Siena: A Fearless Voice for Christ and the Church

Conclave to Open with Most International College of Cardinals in Church History

A Symbol of Faith, Not Fashion: Cross Necklaces Find Renewed Meaning Among Young Catholics and Public Leaders

Daily Catholic

Daily Readings for Wednesday, April 30, 2025

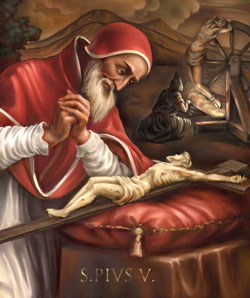

Daily Readings for Wednesday, April 30, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025 Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025

Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025 Daily Readings for Tuesday, April 29, 2025

Daily Readings for Tuesday, April 29, 2025 St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025

St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025- Prayer for the Dead # 3: Prayer of the Day for Tuesday, April 29, 2025

![]()

Copyright 2025 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2025 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Wednesday, April 30, 2025

Daily Readings for Wednesday, April 30, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025 Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025

Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025 St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025

St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025