Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you. Help Now >

Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you. Help Now >

Aged investors keep cool in downturn

FREE Catholic Classes

McClatchy Newspapers (MCT) - "We know that stocks went down 60 to 70 percent then and then came back up. There doesn't appear to be any other alternative than to hold on."

Highlights

McClatchy Newspapers (www.mctdirect.com)

3/30/2009 (1 decade ago)

Published in Business & Economics

These practices might be just what the recent bear markets need, said Janet Fox, an adviser at the ACH Investment Group in Raleigh.

"If people don't have faith in the market and they are not willing to buy, that will have an adverse effect, as we have seen," Fox said. "To varying degrees, we need to have confidence."

The members of the Raleigh Investors Club can look back at as many as six decades of market ups and downs. They're managing to stay calm despite the depressed stock prices and financial turmoil.

"It's not as bad as it could be," said Doug Bryant, 76, retired from the family company Bryant Restaurants, which owns 21 Wendy's restaurants. "There's still a lot of economic activity out there," he said. "The growth has slowed tremendously, but maybe it needed to.

"It's going to come back; when it's going to come back, we don't know. It will probably move up in fits and starts."

Investors in his age bracket tend to have more diversified portfolios and to seek stocks that pay dividends, according to academic research. They've benefited in the long term from that Depression-marked mentality, which helped them retire with relatively few obligations.

"We do have a certain amount of optimism," said Casper Holroyd, 80, a former state representative and former chairman of the Raleigh School Board.

Holroyd, too, is a member of the Raleigh Investors Club. At their latest meeting, the former professionals elected to stick with their holdings _ about $63,000 in assorted equities and about $20,000 in cash and money markets _ and put about $1,800 in new membership money into Google.

"They've got $15 billion in cash and virtually no debt," said Al Lanier, 77, about Google.

These older investors' decision to move forward in perilous economic times rests on an experienced conviction that things will turn around.

"If people can get some confidence back in our banking system, I think we can come back," McMillan said. "The market will rebound strongly."

In a climate that has spooked even recent retirees, another financial adviser said, this mostly 70-plus crowd has a philosophy that many investors could profitably follow: Stick to quality and make sure your immediate needs aren't dependent on the swings of the Dow.

"They understand that you don't invest your short-term emergency money in the stock market," said Mark Fortier, of Edward Jones in Apex, N.C. "You take care of your income needs and your short-term money supply first. When you don't need this money for five years or more, that's when you invest."

Club members take turns offering up stocks as possible buys, conducting research for the presentations. A recent prize acquisition was a budding tech stock called Cree, which they still proudly own. On the other hand, a few flings with some lesser-known "wild" stocks led them to refocus on quality.

"Quality means investing in companies and or industries that over the longer term will be beneficial for you as an investor," Fox said.

"That does not mean every company, or every stock, or every industry is one that you should buy. This isn't the '90s anymore."

Investors around this age group tend to have lived within their means, paid off their homes and secured sources of incomes, more so than the 55-to-65 age group, said Fortier, their adviser.

"The 55 to 65 group retired as early as they possibly could," Fortier said. "They may have put more in the markets than they really should have. They are . . . going to have a struggle."

Just a few years ago, census data showed that the baby boomers were the wealthiest generation. But in the current downturn of housing and financial markets, late boomers, those 45 to 54, have lost 45 percent of their net worth over the last five years.

That's according to a study released last month by a think tank, the Center for Economic and Policy Research.

Fox said some baby boomers face another problem: whether their jobs will survive. "Many folks who thought they might have more time to accrue assets are being faced with ... the economic environment we have today," he said.

Given the markets' uncertainty, one older investor sees merit in simply having some fun with your earnings. Jim Barnhill, who owned a computer management company before retirement, has recently reconsidered telling younger people to put the maximum in retirement accounts.

"You can make the case that, 'What's the use of scrimping and saving every penny?'" he said, noting the poor performance of many portfolios. "You could have bought a Cadillac or a Mercedes and enjoyed yourself."

___

WHEN TO STOP INVESTING

Older people's ability to deal with the complexities of investments and finance can be affected by even the beginning phases of dementia, according to research published in January in the Journal of the International Neuropsychological Society.

"As patients progress to mild and moderate Alzheimer's, cognitive decline accelerates and impairments in financial skills become substantial and widespread," said Daniel Marson, one of the study's authors and director of the Alzheimer's Disease Center at the University of Alabama at Birmingham.

A Duke study in 2007 estimated that about one in seven Americans 71 or older have some form of dementia.

Family members of a person diagnosed with mild cognitive impairment _ a condition that often precedes Alzheimer's _ should urge the person to put estate and financial planning in place before the more severe impairments of dementia arrive.

"As patients progress to mild and moderate Alzheimer's, cognitive decline accelerates and impairments in financial skills become substantial and widespread," Marson said in material provided by UAB.

Doctors working with UAB have developed tests that measure a patient's ability to deal with financial questions from the person's knowledge of personal assets to remembering how to balance a checkbook.

___

© 2009, The News & Observer (Raleigh, N.C.).

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

Novena for Pope Francis | FREE PDF Download

-

- Easter / Lent

- Ascension Day

- 7 Morning Prayers

- Mysteries of the Rosary

- Litany of the Bl. Virgin Mary

- Popular Saints

- Popular Prayers

- Female Saints

- Saint Feast Days by Month

- Stations of the Cross

- St. Francis of Assisi

- St. Michael the Archangel

- The Apostles' Creed

- Unfailing Prayer to St. Anthony

- Pray the Rosary

St. Catherine of Siena: A Fearless Voice for Christ and the Church

Conclave to Open with Most International College of Cardinals in Church History

A Symbol of Faith, Not Fashion: Cross Necklaces Find Renewed Meaning Among Young Catholics and Public Leaders

Daily Catholic

Daily Readings for Wednesday, April 30, 2025

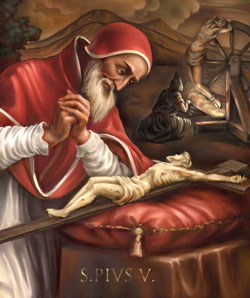

Daily Readings for Wednesday, April 30, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025 Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025

Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025 Daily Readings for Tuesday, April 29, 2025

Daily Readings for Tuesday, April 29, 2025 St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025

St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025- Prayer for the Dead # 3: Prayer of the Day for Tuesday, April 29, 2025

![]()

Copyright 2025 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2025 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Wednesday, April 30, 2025

Daily Readings for Wednesday, April 30, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025 Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025

Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025 St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025

St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025