Companies market peace of mind for layoff-fearing customers

FREE Catholic Classes

The Dallas Morning News (MCT) - Melissa Sparks is a bit nervous about making the biggest investment of her life during the worst economic crisis since the Depression. So she plans to pay a one-time fee of $525 for a security blanket when she buys her first house.

Highlights

McClatchy Newspapers (www.mctdirect.com)

3/26/2009 (1 decade ago)

Published in Business & Economics

A program offered by her lender, Service First Mortgage, promises to pay up to $1,800 in mortgage payments for six months if Sparks is laid off from her surgical coordinator job within the first 24 months of the mortgage.

"It's a small price to pay if something should happen to my job," said Sparks, 30, of Garland, Texas. "It's one less thing to worry about."

Other companies are also using innovative marketing to reduce the risk for cash-strapped consumers and while boosting sales as customers worry about the recession. Carmaker Hyundai will buy back cars from new owners who get laid off, and General Motors is considering copying the program. Some companies offer job loss insurance and similar protection.

The national unemployment rate stands at 8.1 percent _ the highest in 25 years _ and many consumer prices are higher. Even the rich are cutting back on spending.

"Companies doing this are obviously being more aggressive," said David Strutton, a professor of marketing at the University of North Texas. "It's all about creating a strong value proposition for prospects."

Some companies that sell standalone job-loss protection insurance policies, such as Genworth Financial Inc., provide it free as part of mortgage insurance on loans made through lender partners.

"What we're trying to do is keep people in homes," said Chris Antonello, senior vice president of marketing for the Richmond, Va.-based Genworth's U.S. mortgage insurance unit.

Genworth has started notifying new borrowers about the coverage and asking them to register, as they would for a product warranty, he said.

Genworth's coverage pays up to $2,000 per month of mortgage principal, interest, taxes and insurance for up to six months if the borrower is laid off. The company has seen more job-loss insurance claims in the last few months, Antonello said.

Some companies don't market layoff protection as insurance. Service First Mortgage calls it a mortgage protection program. Producers Financial Network's PayCheck Guardian is membership-based. Both include additional services, such as financial counseling, grants for financial emergencies or identity theft protection.

"If it's just a freebie on your existing policy, I don't think you have to worry about it," said Gail Hillebrand, senior attorney for Consumers Union, a national consumer advocacy group and publisher of Consumer Reports magazine. "Generally speaking, single-event insurance is not a good buy. The question is whether you should pay for it or put (the money) in your emergency cash cushion."

Hillebrand also cautioned consumers to look at the fine print on any contract _ whether it's insurance or not _ for exceptions such as not being eligible if you're a temporary worker or if you receive severance pay. "If you meet all of those things, then it's a personal choice," she said.

Texas Department of Insurance spokesman Jerry Hagins urges consumers to be cautious. "Any offer that looks too good to be true may not be true," he said. "It's worth buying a product that's regulated and licensed."

Whether or not they're technically insurance policies, layoff protection programs operate in a similar way. The programs typically don't kick in for 60 days (four months for PayCheck Guardian), and there's a 30-day waiting period before funds are paid. Exclusions include people who are self-employed, independent contractors or military; those who have been fired or quit; or those who are out of work due to a strike or lockout.

PayCheck Guardian provides three standalone insurance-backed product options: Pay $50 a month for $750 in monthly coverage if you lose your job; $60 a month for $1,000 in coverage; and $70 a month for $1,500 in coverage. Customers must be employed and make payments for four months to collect benefits, which last four months.

PayCheck Guardian's customer base has increased monthly since its September launch, said John Hartline, president of North Carolina-based Producers Financial Network. He declined to elaborate but said most customers are from the banking and financial industries.

Linda Davidson, senior loan officer at Service First Mortgage in Richardson, Texas, said that since she began offering the WorryFree Mortgage program last month, she's received enough interest that she recently launched a Web site (myworryfreemortgage.com).

Rainy Day Foundation, the Washington, D.C., nonprofit behind WorryFree Mortgage, provided about $4 million in financial help nationwide last year, or twice as much as in 2007, said senior vice president Robert Clute. He projects nearly $6 million this year.

"A lot of our clients are taking everything they have to get into a home," Davidson said. The program gives them some "peace of mind," she said.

___

LAYOFF PROTECTION TIPS

Gail Hillebrand, senior attorney for Consumers Union, a national consumer advocacy group, recommends you take these steps before signing up for a layoff protection plan:

_ Read the fine print.

_ Make sure you will be covered.

_ Find out exactly what the coverage pays for.

_ Decide if there's a better use for your money.

_ If you're worried about getting laid off and you have $500 to spend, you might want to use it on training or education.

___

© 2009, The Dallas Morning News.

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

Novena for Pope Francis | FREE PDF Download

-

- Easter / Lent

- Ascension Day

- 7 Morning Prayers

- Mysteries of the Rosary

- Litany of the Bl. Virgin Mary

- Popular Saints

- Popular Prayers

- Female Saints

- Saint Feast Days by Month

- Stations of the Cross

- St. Francis of Assisi

- St. Michael the Archangel

- The Apostles' Creed

- Unfailing Prayer to St. Anthony

- Pray the Rosary

St. Catherine of Siena: A Fearless Voice for Christ and the Church

Conclave to Open with Most International College of Cardinals in Church History

A Symbol of Faith, Not Fashion: Cross Necklaces Find Renewed Meaning Among Young Catholics and Public Leaders

Daily Catholic

Daily Readings for Wednesday, April 30, 2025

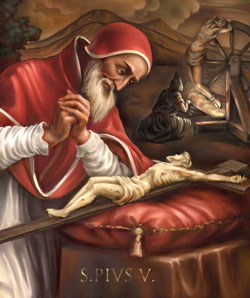

Daily Readings for Wednesday, April 30, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025 Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025

Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025 Daily Readings for Tuesday, April 29, 2025

Daily Readings for Tuesday, April 29, 2025 St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025

St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025- Prayer for the Dead # 3: Prayer of the Day for Tuesday, April 29, 2025

![]()

Copyright 2025 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2025 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Wednesday, April 30, 2025

Daily Readings for Wednesday, April 30, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025 Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025

Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025 St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025

St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025