In hard times, jewelry business loses its luster

FREE Catholic Classes

McClatchy Newspapers (MCT) - Freddy Strauss can gauge the economy by the decline in the size of the diamond engagement rings he's selling at his store here.

Highlights

McClatchy Newspapers (www.mctdirect.com)

2/17/2009 (1 decade ago)

Published in Business & Economics

These days, happy couples are opting for a diamond between Âľ-karat and 1 karat _ half the size of the average ring during boom times.

"I'm probably selling a similar amount, but they're lower-priced," Strauss said.

His business was down low double-digit percentages during the holiday season, normally one of the most popular times for engagements. But Strauss actually is in a better position than many in the jewelry industry. Couples still get married in recessions, and most guys wouldn't think of skipping the engagement ring if they want a happy marriage.

Skipping the gold bracelet or pair of diamond earrings is a different story. As job losses and the stock market crash take their toll on consumer confidence, jewelry has become a luxury many people can't afford. Even those who can are scaling back.

And while Valentine's Day is a popular time for jewelry purchases, most retailers weren't expecting a boom in business around the holiday this year.

"The environment isn't encouraging for people to go out and spend flamboyantly on a $10,000 necklace," said Pam Danziger, president of Unity Marketing, a firm that specializes in luxury consumer behavior.

Retailers are finding ways to cope. Some are bringing in new, lower-priced merchandise, while others are marketing heavily to the ultra-wealthy.

Nationally, the picture is not pretty. Holiday jewelry sales during November and December were down 31 percent at Mayors stores, the bulk of which are located in South Florida. Tiffany was down 35 percent, Zale 19.6 percent. Sterling Jewelers, which owns Jared the Galleria of Jewelry and Kay Jewelers, was down 16.4 percent.

"This year's holiday season has proven to be extremely difficult," said a statement from Thomas A. Andruskevich, president and chief executive of Birks & Mayors, which has co-headquarters in Tamarac, Fla. "The losses suffered by investors in the equity markets, historically low consumer confidence and lack of visibility in the economic outlook resulted in a significant reduction in consumer spending."

Between 1,500 and 2,000 jewelry store locations closed in 2008, including the bankruptcies of major mall-based chains Whitehall and Friedman's jewelers. And the industry is bracing for another difficult year in 2009.

"It's survival mode," said Rob Bates, senior editor of Jewelers Circular Keystone, a leading trade publication. "Companies are just trying to get through this and hope to make it out the other side. In this environment, being big isn't necessarily an asset. A lot of the independents are doing much better by comparison."

Being smaller has proven to be an advantage for many independent jewelers, particularly those who have been in the market for decades and built relationships with their customers. They're holding on, refocusing their merchandise and in some cases even seeing increases in business.

Jeff Malvin, president of Beverly's Jewelers, saw the economy slowdown coming last spring and started adjusting the merchandise at his three Broward County, Fla., stores so he was ready.

By the time the fourth quarter arrived, Malvin had brought in new showcases of lower-priced silver jewelry and other alternative metals in fashion-oriented styles. For Valentine's Day, he's promoting these products with ads, "Look like a million for under $100."

"You've got to pull your head out of the sand and adapt to what's happening," said Malvin, whose sales were flat for 2008, but down for the holidays. "You have to have your finger on the pulse of your local neighborhood. We adjust to the customer's needs. Women still want jewelry, but at a price point they can afford."

H. Bredemeier, owner of H&H Jewels in Coconut Grove, Fla., has been able to spur business by helping clients remodel old jewelry or trade it in for credit on a new purchase.

"The last six months I've done more trades then I've done in the last two years," Bredemeier said. His sales for 2008 were down 30 percent, but that follows a 23.5 percent jump in 2007.

"We're still doing numbers like 2005," he said. "We were making a living in 2005. You just have to readjust."

For Ed Dikes, owner of Weston Jewelers, the adjustment has meant shifting his business in a different direction _ toward the ultra-luxury consumer. He's added more high-priced watches and diamond jewelry at prices of $25,000 and higher. Dikes has found that most of his customer demand is concentrated in that area, as well as some demand for items between $500 and $1,500.

What's disappeared for Dykes and others is the aspirational client, who a couple years ago was trading up and living off a big bonus.

"The high-net-worth client seems to always have the money; they haven't been hit as much," said Dikes, whose strategy helped his business finish 2008 with a sales increase. "The person who was the $10,000 buyer can't afford to make purchases anymore because they're worried about making ends meet."

The economy didn't seem to be putting a damper on the spirits of the luxury consumers who came to celebrate Levinson Jewelers' grand opening this month on Las Olas Boulevard in Fort Lauderdale, Fla. They sipped champagne and checked out items like a 37-karat emerald cut diamond ring for $6 million.

Karon and Lew Cohen were thrilled the Levinsons had found them the 16-karat, three-stone diamond ring they had been searching for.

"Whatever is not here, they can find it for you," said Karon Cohen, a Miami Beach resident who was proudly displaying her new purchase. "They sell you jewelry that suits your personality, not based on just making a sale."

Levinson customer Robert Weinstein is actually buying more jewelry these days for his fiancee, Karina Modrin.

"It's a good investment," said Weinstein, a Boca Raton, Fla., resident who recently purchased a diamond necklace, earrings and engagement ring. "It's like buying fine art. These are all solid commodities. Diamonds are only going to go up. It's better than putting your money in the stock market."

Weinstein isn't the only one. Jewelers in South Florida who cater to the ultra-wealthy say they've seen an increase in customers looking to buy collectable watches, diamonds and gold as investments.

But those customers are being very picky about what they buy, said Sandy Hequin, owner of Morays Jewelers in downtown Miami.

"Bling is out," Hequin said. "Nobody wants to be flashy and call attention to themselves and make others feel bad. They want to be conservative. Classic, investment quality is what people want."

___

© 2009, The Miami Herald.

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

-

- Stations of the Cross

- Easter / Lent

- 5 Lenten Prayers

- Ash Wednesday

- Living Lent

- 7 Morning Prayers

- Mysteries of the Rosary

- Litany of the Bl. Virgin Mary

- Popular Saints

- Popular Prayers

- Female Saints

- Saint Feast Days by Month

- Pray the Rosary

The Diocese of Arlington Calls for Catholics to Unplug for Lent

Sharks Are Not Silent Creatures After All

Ancient Evidence of Jesus’ Crucifixion Found

Daily Catholic

Daily Readings for Friday, March 28, 2025

Daily Readings for Friday, March 28, 2025 St. Venturino of Bergamo: Saint of the Day for Friday, March 28, 2025

St. Venturino of Bergamo: Saint of the Day for Friday, March 28, 2025 Prayer for God's Help in Daily Actions: Prayer of the Day for Friday, March 14, 2025

Prayer for God's Help in Daily Actions: Prayer of the Day for Friday, March 14, 2025 Daily Readings for Thursday, March 27, 2025

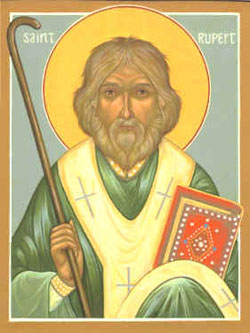

Daily Readings for Thursday, March 27, 2025 St. Rupert: Saint of the Day for Thursday, March 27, 2025

St. Rupert: Saint of the Day for Thursday, March 27, 2025- To Perceive Animals as God's Gifts: Prayer of the Day for Thursday, March 13, 2025

![]()

Copyright 2025 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2025 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Friday, March 28, 2025

Daily Readings for Friday, March 28, 2025 St. Venturino of Bergamo: Saint of the Day for Friday, March 28, 2025

St. Venturino of Bergamo: Saint of the Day for Friday, March 28, 2025 Prayer for God's Help in Daily Actions: Prayer of the Day for Friday, March 14, 2025

Prayer for God's Help in Daily Actions: Prayer of the Day for Friday, March 14, 2025 St. Rupert: Saint of the Day for Thursday, March 27, 2025

St. Rupert: Saint of the Day for Thursday, March 27, 2025