We ask you, urgently: don't scroll past this

Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you.Help Now >

This Silicon Valley stock broker is wise beyond his years

FREE Catholic Classes

San Jose Mercury News (MCT) - In these troubled economic times, I've been listening to San Jose stock broker Andrew Yeh.

Highlights

McClatchy Newspapers (www.mctdirect.com)

2/16/2009 (1 decade ago)

Published in Business & Economics

He strikes me as wise, sensible, someone who's keeping his head as those around him lose theirs. (Not to mention their shirts.)

"I'm not going to sell mine," he says of his stock holdings. "I'm not going to buy any more, either."

Yeh seems unshaken by the worst market he's seen in all his years.

All 13 of them.

Yep, the kid is 13 years old, and apparently the youngest person to become a broker licensed to trade stocks, bonds, options and other securities on behalf of others. A couple of months ago, at age 12, Andrew passed the Financial Industry Regulatory Authority's 250-question Series 7 test on his first try.

"I can work in the industry," Andrew says, sitting in his West San Jose home. "But nobody is going to hire me." Who's going to trust a 13-year-old with their life savings, he asks?

Hey, I tell him, you couldn't do much worse than the grown-ups many investors have trusted with their life savings. But then there are those pesky child-labor laws.

Andrew already manages his mother's $45,000 retirement account, and his 8-year-old sister, Aurora, is trying to wrest her college account from her father.

"She keeps wanting to transfer the money to Andrew," says Jeff Yeh, Andrew's father.

The Financial Industry Regulatory Authority doesn't track brokers by age, but a spokesman there said no one with the agency was aware of any other 12-year-olds even taking the test, let alone passing it.

I know. You can't imagine why a kid would want to take a grueling six-hour test on collateralized mortgage obligations and puts and stops and the like when there is so much MTV to watch. Maybe you can't imagine what it's like to be 12, either.

Twelve-year-olds get ideas _ unshakable ideas. They have not lived long enough to learn that you actually can't be whatever you want to be. And Andrew had something to prove to himself and others who might not believe that he, at age 10, started managing his own college fund and was doing pretty well until recently.

"Even if I grow my portfolio," Andrew says, "they'll say my dad did it."

So last summer he picked up a 4-inch-thick test prep book and an instructional CD-ROM and spent his days studying.

Yes, Andrew is a sharp eighth-grader. He skipped third grade and he gets A's and B's at Harwood Challenger School. In his spare time he competes in chess tournaments and solves complex math problems in his head.

So maybe it's no surprise he scored an 88 on the test, which requires a 70 percent to pass.

There were a few catches when it came to taking the test. First, Andrew's mother, Inder Peng, explains, the regulatory authority asks for a 10-year work history as part of a background check.

"Ten years ago he was a baby," Peng says. "So I put he was with the nanny." From there, she says, he went to AppleSeed Montessori School, so she included that.

Oh, and regulators require that test-takers be affiliated with a securities firm. So Andrew got a San Jose broker he met at a seminar to sponsor him.

Andrew has not been immune from the market's collapse. He says he's held half his $9,000 portfolio in cash. Still, he's down 20 percent for the year and his stocks are down 40 percent or so, he says.

But there are bright spots. His holdings saw some improvement recently, he says, "because one of my companies received preferential tax treatment." And he sees good things ahead for his struggling stock in SORL, a Chinese auto parts company.

"It has more cash in investments than their total debt. Also, the tire business in China has grown like 28 percent."

And the downturn, he says with the wisdom of his years, will not last forever.

"I think stocks will go back up."

Andrew can wait. After all, he's in it for the long haul.

(EDITORS: STORY CAN END HERE)

___

COULD YOU PASS THE STOCK BROKER TEST?

Sample questions:

1. A customer has a short margin account with a short market value of $22,000, a credit balance of $42,000 and SMA of $500. What is the equity in the account?

A) $500

B) $20,000

C) $20,500

D) $37,000

Correct answer is B: The equity in a short margin account is equal to the credit balance minus the short market value. SMA is not used when computing equity.

2. Assuming all of the following bonds from the same issuer are callable now, which one would most likely get called first?

A) 8 percent maturing 1-15-2016

B) 8 percent maturing 1-15-2007

C) 4 percent maturing 1-15-2012

D) 4 percent maturing 1-15-2007

Correct answer is A: Bonds with the highest coupon rates and longest maturity would be the first to most likely get called.

3. Customers who engage in increased activity of wiring money from their account could indicate which of the following activities?

A) Interpositioning

B) Churning

C) Crossing

D) Money laundering

Correct answer is D: Potential money laundering activities include excessive wiring of money between accounts.

Source: Global Career Schools online training program; www.globalcareerschools.com

___

(Mike Cassidy is a technology columnist for the San Jose Mercury News. Read his Loose Ends blog at blogs.mercurynews.com/Cassidy and contact him at mcassidy@mercurynews.com or (408) 920-5536.)

___

© 2009, San Jose Mercury News (San Jose, Calif.).

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

Novena for Pope Francis | FREE PDF Download

-

- Easter / Lent

- Ascension Day

- 7 Morning Prayers

- Mysteries of the Rosary

- Litany of the Bl. Virgin Mary

- Popular Saints

- Popular Prayers

- Female Saints

- Saint Feast Days by Month

- Stations of the Cross

- St. Francis of Assisi

- St. Michael the Archangel

- The Apostles' Creed

- Unfailing Prayer to St. Anthony

- Pray the Rosary

St. Catherine of Siena: A Fearless Voice for Christ and the Church

Conclave to Open with Most International College of Cardinals in Church History

A Symbol of Faith, Not Fashion: Cross Necklaces Find Renewed Meaning Among Young Catholics and Public Leaders

Daily Catholic

Daily Readings for Wednesday, April 30, 2025

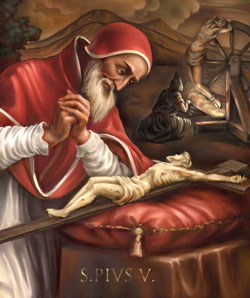

Daily Readings for Wednesday, April 30, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025 Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025

Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025 Daily Readings for Tuesday, April 29, 2025

Daily Readings for Tuesday, April 29, 2025 St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025

St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025- Prayer for the Dead # 3: Prayer of the Day for Tuesday, April 29, 2025

![]()

Copyright 2025 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2025 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Wednesday, April 30, 2025

Daily Readings for Wednesday, April 30, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025 Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025

Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025 St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025

St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025