We ask you, urgently: don't scroll past this

Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you.Help Now >

Investing in debt might beat stocks

FREE Catholic Classes

McClatchy Newspapers (MCT) - Mark Yusko is an experienced hand at managing big money.

Highlights

McClatchy Newspapers (www.mctdirect.com)

1/12/2009 (1 decade ago)

Published in Business & Economics

He used to oversee the University of North Carolina-Chapel Hill's endowment. Now his own firm, Morgan Creek Capital in Chapel Hill, has $10 billion under management.

It's a thriving _ and expanding _ business that employs 50 people worldwide. It likely will boost employment by about 25 percent this year. Here's his investment insight for 2009.

_ Separate the economy from the stock market. "The economy and the markets actually have not been very linked over time," Yusko said.

From 1966 to 1982, for example, the economy grew 75 percent in real terms, yet the market was flat. From 1982 to 1999, the economy also grew 75 percent in real terms, he said, and the market went up 11-fold.

The market also tends to lead the economy.

"The market goes down 45 percent before recession is called," Yusko said. So the market saw the recession was here last year and adjusted.

"People are moaning that the economy is going to be bad in '09," Yusko said. "It probably is. And that may already be reflected in the market."

_ All stocks aren't cheap. There's a perception that stocks are on sale because shares have fallen dramatically as the recession has taken hold.

Be careful, Yusko said.

The price-to-earnings ratio, a measure that helps determine a stock's value, might not have gone down at all. So some stock prices, while lower, aren't really a steal.

Yusko said some investments in the financial, energy and real estate sectors could prove bargains, depending on investors' time horizon. He also likes investments linked to emerging economies.

"Your investment time horizon should be multi-year," Yusko said. "Our job for our clients is to keep them focused on the long term, recognizing when you have markets that go down a lot _ oil markets, or natural gas markets or stock markets _ there will be opportunities, but you have to sift through those opportunities and think about valuation."

_ Stocks might not be the best bet. "We see great opportunity in debt," Yusko said. "Debt is the new equity, kind of like red is the new black."

Delving into such investments, though, requires a more sophisticated understanding of a company's capital structure, which typically is made up of bank debt, bonds, preferred stock and common stock. Equity has a lot of upside in boom times, but more downside in bad times. That's because common shareholders are last in line to get paid when a company fails. Usually, they don't get anything.

Bond holders, on the other hand, get preference for payment after banks. In this time of uncertainty, then, debt is a higher-quality investment.

"My guess is we'll have a little more tumult between now and middle of the year," Yusko said. "If I own debt, I don't have to worry about that."

As for the outlook for this year, Yusko did take one lesson from 2008 that will stick with him.

"Expect the unexpected," he said.

___

© 2009, The News & Observer (Raleigh, N.C.).

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

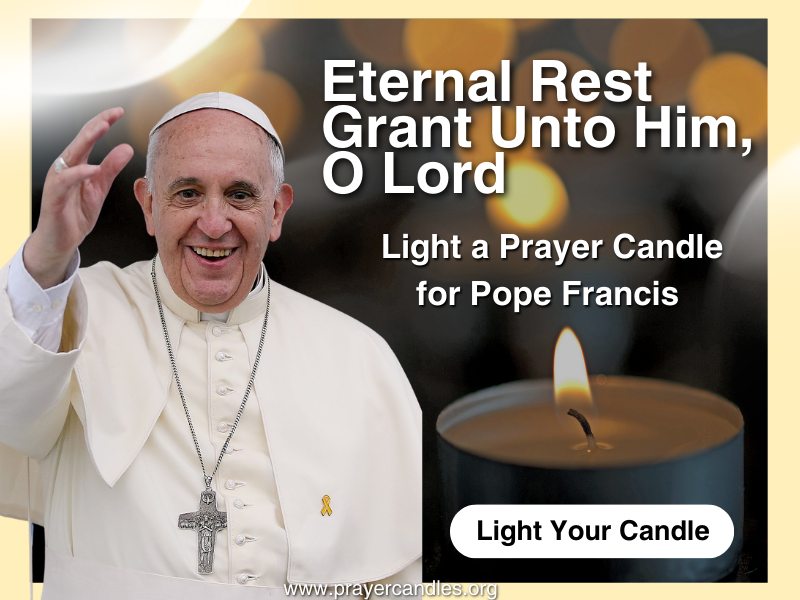

Novena for Pope Francis | FREE PDF Download

-

- Easter / Lent

- Ascension Day

- 7 Morning Prayers

- Mysteries of the Rosary

- Litany of the Bl. Virgin Mary

- Popular Saints

- Popular Prayers

- Female Saints

- Saint Feast Days by Month

- Stations of the Cross

- St. Francis of Assisi

- St. Michael the Archangel

- The Apostles' Creed

- Unfailing Prayer to St. Anthony

- Pray the Rosary

St. Catherine of Siena: A Fearless Voice for Christ and the Church

Conclave to Open with Most International College of Cardinals in Church History

A Symbol of Faith, Not Fashion: Cross Necklaces Find Renewed Meaning Among Young Catholics and Public Leaders

Daily Catholic

Daily Readings for Wednesday, April 30, 2025

Daily Readings for Wednesday, April 30, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025 Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025

Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025 Daily Readings for Tuesday, April 29, 2025

Daily Readings for Tuesday, April 29, 2025 St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025

St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025- Prayer for the Dead # 3: Prayer of the Day for Tuesday, April 29, 2025

![]()

Copyright 2025 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2025 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Wednesday, April 30, 2025

Daily Readings for Wednesday, April 30, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025 Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025

Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025 St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025

St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025