We ask you, urgently: don't scroll past this

Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you.Help Now >

New year offers chance for a fresh financial start

FREE Catholic Classes

The Dallas Morning News (MCT) - For most of us, 2008 couldn't end soon enough, as millions of consumers lost jobs, retirement funds turned to Swiss cheese and credit dried up.

Highlights

McClatchy Newspapers (www.mctdirect.com)

1/12/2009 (1 decade ago)

Published in Business & Economics

A new year can provide a fresh start and a chance to set new financial goals and correct the mistakes you've made.

"This economic environment has forced clients to have a financial reality check," said Rett Dean, a certified financial planner and development manager at H.D. Vest Financial Services in Irving, Texas.

So, experts advise, you should continue to play financial defense and take these key steps in 2009:

_ "Build a budget," said Gail Cunningham, spokeswoman for the National Foundation for Credit Counseling.

"Once you have tracked your spending, you can then categorize it starting with living expenses, followed by debt repayment. At this point you may discover that you've got more month than money, but that's OK because you're now in control of your finances, thus you can take the necessary steps to resolve any deficit."

_ Save, save, save.

"There should be an increased emphasis on accumulating an adequate emergency savings fund," said Greg McBride, senior financial analyst at Bankrate.com, a personal finance Web site.

"Job losses are on the rise, and nothing will help you sleep better at night than knowing you have money tucked away for a rainy day."

Most financial advisers recommend you stash away funds equivalent to six months' worth of your expenses, but today's dismal job market calls for as much savings as you can muster.

"There are over 2 million people who have been out of work at least six months, so even that may not be sufficient to weather a period of joblessness," McBride said.

_ Spend with care.

"In light of the economic environment, people should approach their financial goals by focusing on needs vs. wants," said E. Kim Dignum, certified financial planner at Dignum Financial Services in Fort Worth, Texas.

"Because of all the uncertainty, this is a great time to throttle back on unnecessary spending and focus on long-term goals."

_ Avoid new debt that you can't pay off quickly.

"Attack debt as though it were the enemy, because it is," Cunningham said. "Do not add new debt on top of old."

If the balance on your credit card exceeds 30 percent of the credit limit, devote all extra money to paying down that debt.

"Creditors consider you a risk if you use too much of your available credit, and can then lower your limit and raise your annual percentage rate, making it even harder for you to repay what you owe," Cunningham said. That lowers your credit score, which has taken on huge importance in a person's financial profile.

"Interest rates are low, so use those low interest rates as a tailwind to repay debt," McBride said. "That's what corporations are doing. That's what consumers need to do as well."

_ Focus your investing.

"If anything, people should make a point to resist making knee-jerk changes in their goals," said Ryan Huey, director of financial planning at Perryman Financial Advisory Inc. in Dallas.

"The current economic environment is challenging, as has been the stock market's recent performance, but this is the time to sharpen your focus on your existing goals and not let the 'crisis du jour' derail that focus."

A depressed stock market is the perfect time to snap up stocks at low prices, he said.

"Take this opportunity to increase your 401(k) contribution and ramp up your savings across the board," Huey said.

But make sure your investments are diversified. The market's frenetic pace may have thrown off your mix of stock, bonds and cash, and you may need to rebalance your investments to ensure that they remain aligned with your investment risk tolerance and your age.

"Invest wisely and objectively and try not to get emotionally caught up in the volatility of today's market," Brent Little and his father, John, certified financial planners at Odyssey Wealth Management in Plano, Texas, said in a joint statement. "Develop an investment allocation for the long-term and stick to it. Not adhering to your investment plan and trying to time the market can negatively affect your investment performance."

_ Don't lose hope.

"Consumers have allowed their finances to operate on automatic pilot for too long," Cunningham said. "They are now eager to move back into the driver's seat and get their financial well-being on course.

"The good news is that this is entirely possible, but it all starts with the basics."

___

© 2009, The Dallas Morning News.

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

Novena for Pope Francis | FREE PDF Download

-

- Easter / Lent

- Ascension Day

- 7 Morning Prayers

- Mysteries of the Rosary

- Litany of the Bl. Virgin Mary

- Popular Saints

- Popular Prayers

- Female Saints

- Saint Feast Days by Month

- Stations of the Cross

- St. Francis of Assisi

- St. Michael the Archangel

- The Apostles' Creed

- Unfailing Prayer to St. Anthony

- Pray the Rosary

St. Catherine of Siena: A Fearless Voice for Christ and the Church

Conclave to Open with Most International College of Cardinals in Church History

A Symbol of Faith, Not Fashion: Cross Necklaces Find Renewed Meaning Among Young Catholics and Public Leaders

Daily Catholic

Daily Readings for Wednesday, April 30, 2025

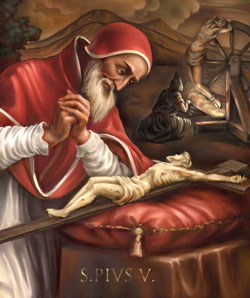

Daily Readings for Wednesday, April 30, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025 Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025

Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025 Daily Readings for Tuesday, April 29, 2025

Daily Readings for Tuesday, April 29, 2025 St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025

St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025- Prayer for the Dead # 3: Prayer of the Day for Tuesday, April 29, 2025

![]()

Copyright 2025 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2025 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Wednesday, April 30, 2025

Daily Readings for Wednesday, April 30, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025 Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025

Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025 St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025

St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025