Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you. Help Now >

Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you. Help Now >

Seniors need to compare drug plans to keep costs down

FREE Catholic Classes

The Dallas Morning News (MCT) - Seniors may see their Social Security increases next year trimmed back by higher prescription costs unless they shop for a Medicare drug plan this fall that better fits their budget.

Highlights

McClatchy Newspapers (www.mctdirect.com)

11/19/2008 (1 decade ago)

Published in Business & Economics

Social Security beneficiaries will get an average of $63 more each month, but part of that increase may be claimed by higher premiums and out-of-pocket costs in their drug coverage.

"Seniors who enrolled in a drug plan several years ago should make sure they're still getting the best value for their dollar," said Terry Warner, president of TexMeds Inc. in Richardson, Texas.

Plans change premiums, deductibles, co-payments and the drugs they cover each year, he said, so the best choice for someone one year may not be the best the next year.

Insurers were required to notify their customers last month of any changes planned for 2009.

The financial crisis has made it especially important for seniors to check the cost and coverage of their drug plans during this year's six-week enrollment period that began Nov. 15, he said.

"Like everyone else, retirees are feeling the pinch," said Warner, who helps seniors evaluate their insurance. "Now is no time to give insurers more money than necessary."

If consumers remain in their current Medicare drug plan, they'll pay an average of 24 percent more in premiums next year, according to an analysis by Avalere Health, a health care consulting firm.

Consumer advocates say the motto for this fall's enrollment period should be "Shop till your drug costs drop."

The highest-priced plans offer the broadest coverage, such as help with generic drugs in the "doughnut hole," where beneficiaries with standard coverage bear the full cost of their prescriptions.

The hole will be larger in 2009. Seniors without gap protection will pay the full price of their prescriptions after their total drug expenses reach $2,700 next year, up from $2,510 this year.

They are then on their own until their out-of-pocket expenses hit $4,350, compared with $4,050 in 2008. At that point, catastrophic coverage kicks in, and Medicare pays 95 percent of the bills.

Seniors need to consider more than premiums, said Jim Yocum, executive vice president of DestinationRx, which helps people compare plans.

"Premiums are only one component," he said. "Even more important are the costs of the drugs and the co-payments or coinsurance amounts that beneficiaries must pay."

UnitedHealth Group, which sells some of the most popular Medicare drug plans, will drop the premiums on some of its four plans and raise some co-payments in 2009.

The insurer is also offering "zero-dollar co-payments" on common generic drugs ordered by mail, said Dr. Michael Anderson, vice president of UnitedHealth Group's clinical pharmacy services.

Yocum said a number of insurers are trying to gain a competitive edge over the $4 drugs at discount stores by promoting no co-payments on popular generics.

Because of the changes in plans, the only practical way to compare drug coverage and out-of-pocket costs is to use Medicare's online "plan finder" at www.medicare.gov, consumer advocates say.

Seniors enter their ZIP code, the names and dosages of their drugs and how often they take them. The online tool shows which plans cover those drugs and the likely out-of-pocket expenses, month by month, for the year.

People without access to the Internet can get the same information by calling Medicare's toll-free help line at 1-800-633-4227 and visiting with one of the agency's service representatives.

Government officials are stepping up efforts to encourage low-income Medicare beneficiaries to apply for extra help with drug costs.

Eligible seniors can get help paying for their drug plan's monthly premiums, annual deductibles, co-payments and any costs they may have in the doughnut hole.

The amount of extra assistance depends on your income and assets. Single people can qualify with annual incomes below $15,600 and resources under $11,990. Couples must have incomes below $21,000 and resources under $23,970.

"Many people have paid needlessly for their prescription coverage because they aren't aware of the extra help," said Carolyn Toliver, a benefits counseling coordinator at the Dallas Area Agency on Aging.

After beneficiaries complained of high-pressure sales tactics by insurance agents a year ago, Medicare revised the rules that insurers must follow in marketing their plans.

"If a sales agent comes to your door uninvited or calls without your asking, he's breaking the law," said Robert Hayes, president of the Medicare Rights Center, a consumer advocacy group. "Don't let him in or talk to him."

Carter urges seniors to compare not only costs and coverage but also customer service in evaluating insurers.

Medicare's improved plan finder now rates plans on the quality of their customer service, the accuracy of their drug price information and their responsiveness to customer complaints. The ratings range from one star, for poor, to five stars, for excellent.

(EDITORS: STORY CAN END HERE)

___

Get help with your choices

Online: Compare drug coverage on Medicare's plan finder at www.medicare.gov.

By phone: Call Medicare at 1-800-633-4227.

SOURCE: Dallas Morning News research

___

© 2008, The Dallas Morning News.

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

Novena for Pope Francis | FREE PDF Download

-

- Easter / Lent

- Ascension Day

- 7 Morning Prayers

- Mysteries of the Rosary

- Litany of the Bl. Virgin Mary

- Popular Saints

- Popular Prayers

- Female Saints

- Saint Feast Days by Month

- Stations of the Cross

- St. Francis of Assisi

- St. Michael the Archangel

- The Apostles' Creed

- Unfailing Prayer to St. Anthony

- Pray the Rosary

St. Catherine of Siena: A Fearless Voice for Christ and the Church

Conclave to Open with Most International College of Cardinals in Church History

A Symbol of Faith, Not Fashion: Cross Necklaces Find Renewed Meaning Among Young Catholics and Public Leaders

Daily Catholic

Daily Readings for Wednesday, April 30, 2025

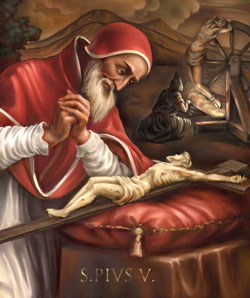

Daily Readings for Wednesday, April 30, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025 Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025

Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025 Daily Readings for Tuesday, April 29, 2025

Daily Readings for Tuesday, April 29, 2025 St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025

St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025- Prayer for the Dead # 3: Prayer of the Day for Tuesday, April 29, 2025

![]()

Copyright 2025 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2025 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Wednesday, April 30, 2025

Daily Readings for Wednesday, April 30, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025 Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025

Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025 St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025

St. Catherine of Siena: Saint of the Day for Tuesday, April 29, 2025