We ask you, urgently: don't scroll past this

Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you.Help Now >

College savings, strategies key as credit crunch hits loan market

FREE Catholic Classes

MarketWatch (MCT) - With the credit crunch crimping the student loan market and financial market upheaval crunching investments in college savings plans, what's a parent to do? That depends somewhat on when your child will need those college funds.

Highlights

McClatchy Newspapers (www.mctdirect.com)

10/6/2008 (1 decade ago)

Published in Business & Economics

If you've got a long time horizon, some say investing in the tax-advantaged college-savings tools known as 529 plans still makes sense. Investors contribute after-tax dollars; investment gains are tax-free if the money is used for qualified education expenses.

"The long-term appeal of 529 plans, despite all the painful losses in recent months, is still very much intact," said Marta Norton, senior mutual fund analyst with investment research firm Morningstar Inc., in Chicago.

"If you saw higher expenses or a management team that had changed, those would be reasons to consider switching funds, but solely because of painful performance over a year's span isn't reason to jump ship," she said. Search for "529 plans" on Morningstar.com to see the firm's take on the five best and worst plans. Note that, with some exceptions, 529 plan investors can generally change their investment options only once a year.

Overall, the investment portfolios offered through all 529 plans tracked by Morningstar were down 6.09 percent on average for the year ending Aug. 31, while they were up 6.06 percent over five years, annualized. An individual investor's return will depend on specific investment choices.

Some argue that even those with kids closer to college age might consider 529 plans' conservative, principal-protection choices. Even with a kid in high school, "it's never too late to save money," said Ray Loewe, president of College Money, a Marlton, N.J., financial-planning firm that counsels parents on college funding. "You're going to be very conservative. But you still have the opportunity" to enjoy the tax-free earnings if the money is used to pay for college.

Still, the recent stomach-turning stock market volatility might make investing for college a tough route for some. If you're in panic mode and want to pull your money out of a 529 plan, ask the college about prepaying so you still get the tax benefits, Loewe said. Also, ask the college about any possible discounts for prepaying. "It never hurts to ask," he said.

No matter how you do it, saving something is getting more important as the credit crunch limits loan availability. Fewer lenders are participating in the federal student-loan program, and about 33 lenders have stopped offering new private loans, said Mark Kantrowitz, publisher of FinAid.org, a financial aid information site.

Still, Congress shored up the federal program by increasing the maximum annual unsubsidized loan amount for some students by $2,000, among other measures in a law enacted in May.

To improve your chances of being able to fund college, consider the following strategies:

_ Apply to many schools to increase the number of financial aid offers you receive. "We recommend kids apply to 10 schools, so they get accepted to three or four schools. That's going to increase their financial aid options," said Dave Kenney, chief executive officer of CollegeZapps, a Littleton, Colo.-based provider of college application tools.

_ Don't rule out private colleges. Their tuition costs are steep, but these schools often have more ability than state schools to offer scholarships or tap endowment funds to help students, Kenney said.

_ Talk to family members. Grandparents are often willing to help with a gift or loan. Set up a savings plan and ask for matching contributions, Loewe said.

_ Talk to the financial aid office. School financial aid officers have a good handle on available grants, scholarships and loans. Once a school offers admission, it's invested a chunk of money so will usually want to help figure out financing. Also, ask your student's high school about local scholarships, and your employer, too.

_ Seek federal loans first. They're more available and generally cheaper. Meanwhile, improve parents' and student's credit scores by paying down debt to help ensure you're eligible for the lowest rates if you need a private loan with a co-signer.

___

© 2008, MarketWatch.com Inc.

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

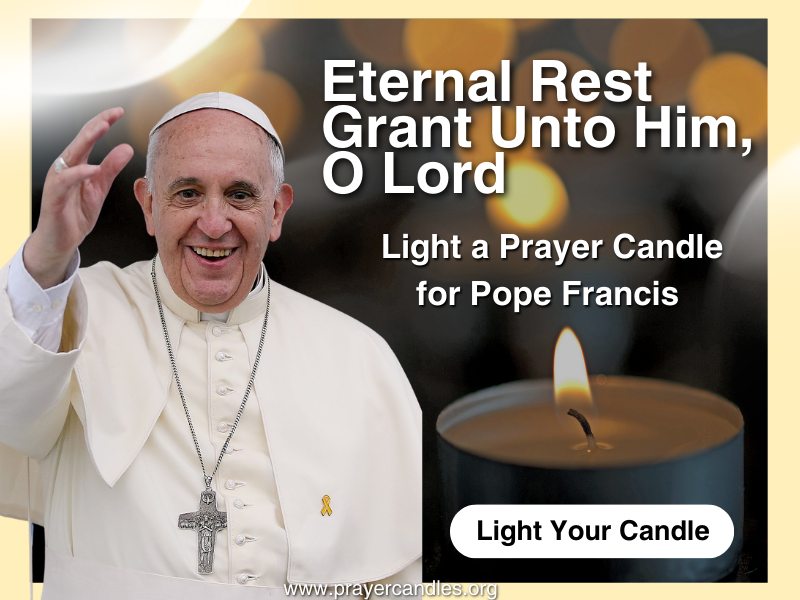

Novena for Pope Francis | FREE PDF Download

-

- Easter / Lent

- Ascension Day

- 7 Morning Prayers

- Mysteries of the Rosary

- Litany of the Bl. Virgin Mary

- Popular Saints

- Popular Prayers

- Female Saints

- Saint Feast Days by Month

- Stations of the Cross

- St. Francis of Assisi

- St. Michael the Archangel

- The Apostles' Creed

- Unfailing Prayer to St. Anthony

- Pray the Rosary

St. Catherine of Siena: A Fearless Voice for Christ and the Church

Conclave to Open with Most International College of Cardinals in Church History

A Symbol of Faith, Not Fashion: Cross Necklaces Find Renewed Meaning Among Young Catholics and Public Leaders

Daily Catholic

Daily Readings for Thursday, May 01, 2025

Daily Readings for Thursday, May 01, 2025 St. Marculf: Saint of the Day for Thursday, May 01, 2025

St. Marculf: Saint of the Day for Thursday, May 01, 2025 To Saint Peregrine: Prayer of the Day for Thursday, May 01, 2025

To Saint Peregrine: Prayer of the Day for Thursday, May 01, 2025 Daily Readings for Wednesday, April 30, 2025

Daily Readings for Wednesday, April 30, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025- Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025

![]()

Copyright 2025 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2025 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Thursday, May 01, 2025

Daily Readings for Thursday, May 01, 2025 St. Marculf: Saint of the Day for Thursday, May 01, 2025

St. Marculf: Saint of the Day for Thursday, May 01, 2025 To Saint Peregrine: Prayer of the Day for Thursday, May 01, 2025

To Saint Peregrine: Prayer of the Day for Thursday, May 01, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025