We ask you, urgently: don't scroll past this

Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you.Help Now >

Profit, progress in sight for car sharing rivals

FREE Catholic Classes

MarketWatch (MCT) - A battle between big business, a possible IPO candidate and numerous nonprofits is brewing in the world of car sharing, and a potential windfall awaits those who can tap into what some see as a multibillion-dollar industry.

Highlights

McClatchy Newspapers (www.mctdirect.com)

10/3/2008 (1 decade ago)

Published in Business & Economics

Or not. With profits proving scarce up to this point, the eventual winners may not be measured by dollars, at all.

And that's just fine for the myriad of nonprofit agencies around the country, who regard car sharing as part of broader transit systems with the sole aim of improving the quality of life for not only their customers but for the public at large.

"Anybody looking to make lots of money should probably look elsewhere," said Rick Hutchinson, chief executive of San Francisco-based nonprofit City CarShare. "We exist only to solve a social problem: The overdependence on the automobile."

Others companies, like those answering to shareholders, see it differently. Zipcar Inc., for instance, smells a market primed for frenetic growth while rental car giants are whetting their beaks in hopes of cashing in on what may or may not turn out to be a lucrative venture.

"We definitely see this as a mainstream service. Just two or three years ago people were still questioning just how big is this going to be," said Zipcar CEO Scott Griffith. "The conclusion is that this is going to be a huge category."

Griffith points out that Zipcar is already making money in the big U.S. cities like New York and San Francisco, and that the overall profit will come when the business matures in more recently launched markets like Vancouver and London.

Hutchinson's City CarShare and the like have carved out their niche primarily in cities and college towns, offering hourly rentals for about $6.50 an hour. An application and annual fee is oftentimes charged as well.

This is nothing new around the world. European cities, not nearly as car-centric as those in the U.S., have offered car sharing for decades. The real global push gathered momentum in the late 1980s, when several nonprofits started popping up in Germany, Canada and the U.S.

Later, businesses emerged that were convinced profits could be made from what had initially been an industry seen as an extension of public transportation systems.

Today Cambridge, Mass.-based Zipcar, after swallowing up rival Flexcar last year, is the industry's biggest player. And while the marketing team likes to speak of easing congestion, reducing emissions and alleviating oil dependence, making money is clearly a top priority.

That's something that Zipcar, despite its growing revenue stream, has yet to accomplish. But Griffith vows that it's just a matter of time.

"If we opened no new cities, we'd be profitable by next year. But with the market expansion as attractive as it is now we're going to launch in new cities," he said.

Still, as the competition mounts, the for-profit companies face a steep challenge, according to Dave Brook, who founded Carsharing Portland in 1998 and now works as an independent consultant for the industry.

"The nonprofits have lower requirements for return on investment and they don't have an extra layer or two of management to support _ 'lean' as they say in business _ so they can survive with much slimmer profit margins," Brook said.

Greater scale may be the key to make up for the thin margins.

Currently, Zipcar's member base is approaching a quarter of a million, with the company looking for 500,000 customers within three years as gas prices hover near record-high levels and the broader economy keeps the pressure on consumers.

The company makes a compelling case for cost-savings. Zipcar even claims that vehicle owners who rely heavily on their own car can cut their costs in half by switching to car sharing.

By Zipcar's estimates, total car ownership costs come to $769 a month for something like a Chevy Impala or Ford Fusion. In contrast, the company's service, which allows customers to choose between vehicles like Minis, BMWs, hybrids and pickups, would cost $322 a month for drivers logging 10 two-hour, 2 three-hour and 2 full-day reservations.

"But there is so much more going on here than hourly pricing," Griffith said. "This is about a new brand, a new way of life for people in the cities. It's not a transaction-based business, it's a membership, almost subscription-model business."

Griffin exudes confidence in his business approach, but he doesn't discount the mounting efforts by the competition.

"There's room for several players to create a multibillion-dollar industry with millions of members in North America alone within 5 to 10 years," he said. "Our vision for the future is to deliver a business that results in more car sharers than car owners in the major cities."

(EDITORS: STORY CAN END HERE)

Of course, those kind of gaudy projections aren't lost on the major players in the car rental industry, though efforts on their part seem to have been half-hearted to this point.

Over the summer, Mark Frissora, CEO of Hertz Global Holdings Inc., told The New York Times that his company would be "in (the car-sharing business) big within the next six months," which triggered speculation that either Hertz could buy a smaller company or build out its own.

Hertz spokesman Rich Broome pointed to the latter: "What I can say is we will launch a new car-sharing initiative later this year in a few major cities _ and we have global reach _ expanding to additional cities and other major markets in 2009," he said.

City CarShare's Hutchinson didn't name Hertz, or any other company specifically, but said he's been in discussions about potential deals and partnerships. "We've talked with multiple car rental agencies, but they ultimately believe they can pull it off themselves," he explained.

That hasn't happened yet and any effort from the big corporations have come up short. This kind of competitive scenario is a familiar one.

Take Netflix vs. Blockbuster, a heated rivalry in the DVD rental business. Essentially, a small startup in an emerging space makes enough noise that big players from the broader industry take notice. But attempts from the mega-corporations often can come off as heavy handed and lacking the savvy of the first mover.

U Car Share, a division of U Haul, is the only other national car-sharing service besides Zipcar. One knock against it is that the company offers only Chrysler PT Cruisers, not exactly a sexy ride _ though U Car Share has vowed to add more models.

Another complaint, at least initially, was the fact that customers could pick up cars only during business hours. And only at U-Haul stores. Now renters can get access to the cars 24 hours a day. Such missteps have played into the hands of Zipcar and the nonprofits.

Enterprise Rent-A-Car may be closest to truly bridging the gap between the for-profits and nonprofits. The rental giant, in a partnership with the nonprofit St. Louis Car Sharing Cooperative, earlier this year launched a car-sharing program in its home town called WeCar.

"This is the first time a rental-car company has been able to create a system that actually looks like and feels like a car-sharing business should," Hutchinson said.

Still, industry observers say Enterprise's venture has struggled to gain traction as a profitable undertaking, though the company won't confirm whether it's losing money on it.

"The reason we get into any business is to make a profit," Enterprise spokeswoman Lisa Martini said. "For the most part, WeCar has been a success and expanding our retail car-sharing business isn't out of the question, but we're just not there yet."

All in all, Hutchinson questions whether the rental giants, with their deep pockets and relatively lengthy reach, can succeed without moving full throttle into the business. Or whether succeeding, as executives and shareholders would define it, is even possible.

"Rental cars seem to still look at the business as small potatoes," Hutchinson said. "We think we've only hit the tip of the iceberg as far as the size of the market for car sharing."

___

© 2008, MarketWatch.com Inc.

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

Novena for Pope Francis | FREE PDF Download

-

- Easter / Lent

- Ascension Day

- 7 Morning Prayers

- Mysteries of the Rosary

- Litany of the Bl. Virgin Mary

- Popular Saints

- Popular Prayers

- Female Saints

- Saint Feast Days by Month

- Stations of the Cross

- St. Francis of Assisi

- St. Michael the Archangel

- The Apostles' Creed

- Unfailing Prayer to St. Anthony

- Pray the Rosary

St. Catherine of Siena: A Fearless Voice for Christ and the Church

Conclave to Open with Most International College of Cardinals in Church History

A Symbol of Faith, Not Fashion: Cross Necklaces Find Renewed Meaning Among Young Catholics and Public Leaders

Daily Catholic

Daily Readings for Thursday, May 01, 2025

Daily Readings for Thursday, May 01, 2025 St. Marculf: Saint of the Day for Thursday, May 01, 2025

St. Marculf: Saint of the Day for Thursday, May 01, 2025 To Saint Peregrine: Prayer of the Day for Thursday, May 01, 2025

To Saint Peregrine: Prayer of the Day for Thursday, May 01, 2025 Daily Readings for Wednesday, April 30, 2025

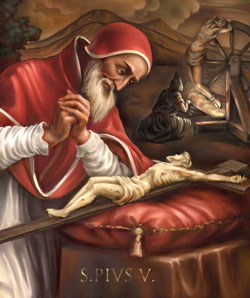

Daily Readings for Wednesday, April 30, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025- Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025

![]()

Copyright 2025 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2025 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Thursday, May 01, 2025

Daily Readings for Thursday, May 01, 2025 St. Marculf: Saint of the Day for Thursday, May 01, 2025

St. Marculf: Saint of the Day for Thursday, May 01, 2025 To Saint Peregrine: Prayer of the Day for Thursday, May 01, 2025

To Saint Peregrine: Prayer of the Day for Thursday, May 01, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025