We ask you, urgently: don't scroll past this

Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you.Help Now >

Bailout means every budget will be bitten

FREE Catholic Classes

Detroit Free Press (MCT) - Why bail out Wall Street?

Highlights

McClatchy Newspapers (www.mctdirect.com)

9/29/2008 (1 decade ago)

Published in Business & Economics

Many families, rightfully so, are angry about the potential taxpayer tab. They pay mortgages on time, skip the trips to Disney World, bag a lunch a few days a week and live for years without granite countertops.

Who truly wants to pay higher taxes to lend a hand to some deadbeat in Manhattan? Or Macomb County?

When a friend called me in an uproar Monday and asked me why he should get stuck paying the bill, I gave him my honest, simple answer. "When some jerk starts a fire in a forest in California, somebody has to put it out."

We live in a world where plenty of jerks start fires _ and where, fortunately, plenty of well-educated men and women engineer ways to put them out.

So, when the top Financial Shock Doc, Treasury Secretary Henry Paulson, says Washington must deal with all those toxic mortgage securities quickly to unfreeze credit markets, I believe him.

The U.S. financial system moved dangerously close to falling off the cliff last week. Banks didn't want to lend money to other banks. Big and small investors pulled billions of dollars out of money market funds in a panic. Oh, did I mention, the stock market spun investors on a Blue Streak roller coaster?

"Basically, the financial community was stuffing money in the mattress on Thursday," said Jim Glassman, senior economist for JPMorgan Chase in New York.

This week, it's hard to judge whether even more money could head to the mattresses, as Congress attempts to craft a rescue package for the worst financial crisis in 80 years.

The Dow Jones Industrial Average plummeted. Stock prices tumbled, oil prices rose and tempers skyrocketed on anxiety over the proposed U.S. Treasury plan to spend up to $700 billion to take bad debt off financial balance sheets.

Why bail out Wall Street?

Dana Johnson, Comerica's chief economist, based in Dallas, said desperate times call for desperate measures, such as one of the biggest bailouts in U.S. history.

"The intent here isn't to save Wall Street," Johnson said. "The intent here is to save Main Street."

He calls the run on money market funds last week the "modern face of a run on a bank."

"We've all seen 'It's a Wonderful Life,'" Johnson said.

The 1946 James Stewart classic features a scene where savers in Bedford Falls are demanding their money in a panic.

Right now, many of us feel a sense of panic _ and yes, outrage. Every other day, it seems like somebody wants some kind of deal or bailout _ Fannie Mae and Freddie Mac, American International Group Inc., the automakers. (The automakers say their pitch for direct government loans is not a bailout.)

Lehman Brothers did not get a bailout, but its bankruptcy sure caused plenty of panic.

Now, why a $700-billion plan to save financial markets? Why bail out Wall Street?

"In a sense, you're bailing yourself out. If Wall Street doesn't get help, it could take the economy with it _ and your job," said Mark Zandi, chief economist and cofounder of Moody's Economy.com.

Zandi's new book is titled "Financial Shock: A 360-degree Look at the Subprime Mortgage Implosion, and How to Avoid the Next Financial Crisis" (FT Press, $24.99).

He said many people don't understand how close the financial system was to collapse. But it's shocking that so many investors feared that even so-called safe money wasn't safe anymore after one money market fund ran into serious trouble. The federal government even had to quickly cook up a way to insure moneymarket funds against losses for the next year.

Zandi supports a plan where the Treasury would buy the troubled assets, hold them until the markets regain their footing and then sell those assets back to investors.

He notes that financial firms would still have to sell their assets to the government at a loss; they might get 50 cents or less on the dollar.

Some financial firms could still fail, even with a bailout, he said.

The key is to rebuild confidence, avoid a higher jobless rate and allow the credit markets to work a way out of this mess eventually.

Zandi, who warned about six months ago that such special government program would be necessary to deal with all the bad mortgage-related debt, said dramatic measures are needed.

Most of the public, obviously, has been against a bailout for several months, but a bailout has become essential after recent events.

"None of us benefits by having a financial system that goes into a death spiral," Glassman said.

___

(Susan Tompor is the personal finance columnist for the Detroit Free Press. She can be reached at stompor@freepress.com.)

___

© 2008, Detroit Free Press.

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

Novena for Pope Francis | FREE PDF Download

-

- Easter / Lent

- Ascension Day

- 7 Morning Prayers

- Mysteries of the Rosary

- Litany of the Bl. Virgin Mary

- Popular Saints

- Popular Prayers

- Female Saints

- Saint Feast Days by Month

- Stations of the Cross

- St. Francis of Assisi

- St. Michael the Archangel

- The Apostles' Creed

- Unfailing Prayer to St. Anthony

- Pray the Rosary

St. Catherine of Siena: A Fearless Voice for Christ and the Church

Conclave to Open with Most International College of Cardinals in Church History

A Symbol of Faith, Not Fashion: Cross Necklaces Find Renewed Meaning Among Young Catholics and Public Leaders

Daily Catholic

Daily Readings for Thursday, May 01, 2025

Daily Readings for Thursday, May 01, 2025 St. Marculf: Saint of the Day for Thursday, May 01, 2025

St. Marculf: Saint of the Day for Thursday, May 01, 2025 To Saint Peregrine: Prayer of the Day for Thursday, May 01, 2025

To Saint Peregrine: Prayer of the Day for Thursday, May 01, 2025 Daily Readings for Wednesday, April 30, 2025

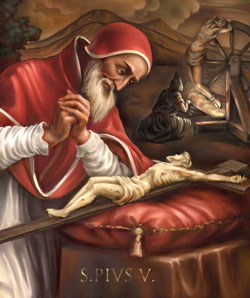

Daily Readings for Wednesday, April 30, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025- Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025

![]()

Copyright 2025 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2025 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Thursday, May 01, 2025

Daily Readings for Thursday, May 01, 2025 St. Marculf: Saint of the Day for Thursday, May 01, 2025

St. Marculf: Saint of the Day for Thursday, May 01, 2025 To Saint Peregrine: Prayer of the Day for Thursday, May 01, 2025

To Saint Peregrine: Prayer of the Day for Thursday, May 01, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025