We ask you, urgently: don't scroll past this

Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you.Help Now >

As banks fail, credit unions deserve a look

FREE Catholic Classes

McClatchy Newspapers (MCT) - Typically, people prefer to put their money in large banks. Most like the extra sense of security and the variety of features and services they offer.

Highlights

McClatchy Newspapers (www.mctdirect.com)

9/29/2008 (1 decade ago)

Published in Business & Economics

But lately, Mr. Big Bank has taken on the characteristics of a high maintenance relationship: fickle terms, low returns, hefty fees and _ finally _ the meltdown.

So some people have started flirting with the competition. Credit unions in particular are getting a good once-over, and many like what they see.

"We have seen some pretty strong growth this year," said Joe Mecca, a spokesman for Coastal Federal Credit Union in Raleigh.

Coastal Federal has added 13,600 members this year, an 8.5 percent increase, Mecca said. It also has seen a nearly 60 percent increase in new checking accounts; loans are up 20 percent.

"This is all organic growth," Mecca said. "We have not opened any additional branches."

Consumers are starting to realize that credit unions are no longer small entities with few branches and ATMs, he said.

Coastal, for instance, is part of a national ATM network of credit unions with more than 50,000 machines across the country. Many credit unions are also members of the service center network, which gives credit union members access to 3,400 branches nationwide.

What has remained true of credit unions is they can charge slightly lower-than-average fees for certain services because of their not-for-profit status.

For example, Mecca said, Coastal charges $25 for an overdrawn account and $27 for a bounced check. Holden Lewis with Bankrate.com said some banks charge as much as $35. Coastal has a checking account that pays 5.01 percent interest and requires no minimum balance. It also has competitive credit card rates.

"We don't have to pay dividends to shareholders," Mecca said. "We don't have to go out and make a profit, because the people we are making money off of own us."

Coastal has many of the services offered by the big banks, including online banking and bill payment and trust and investment services.

My favorite? Coastal can prevent members from overdrawing their accounts in most debit card transactions. "If you have only $100 dollars in your account and you try to make a $110 purchase, that purchase will be declined," Mecca said.

Of course, not everyone can join a credit union. Membership is restricted to specific groups, such as employees of certain companies, government workers and churches. Many allow the immediate and extended family of members to join.

Still, switching your checking account to a credit union might not be the best answer. Banks still offer a much wider variety of services, for instance, allowing you to transfer funds to other accounts at different institutions and get access to international branches, foreign currency exchanges and financial planning services. And bank fees for some services are still quite competitive.

Still, you might want to open a credit union account to take advantage of lower rates on auto loans and the like.

In the end, you may find that you can blend the two types of financial institutions together to benefit from the best of both.

If you are considering moving your money to a credit union, you can find out which credit unions are closest to you at www.creditunion.coop and click on "locate a credit union."

You'll also want to make sure that your money is secure. Most credit unions' secure their deposits through the National Credit Union Administration. The NCUA guarantees deposits for credits unions up to $100,000, the same as the FDIC does for banks. Just ask whether the credit union is insured by the NCUA.

And finally, before joining a credit union, thoroughly check out its services to make sure they meet your financial needs. For example, you may want to know if it offers both debit cards and credit cards.

___

(Vicki Lee Parker is a business reporter and financial columnist for The News & Observer in Raleigh, N.C. She can be reached at vparker@newsobserver.com.)

___

© 2008, The News & Observer (Raleigh, N.C.).

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

Novena for Pope Francis | FREE PDF Download

-

- Easter / Lent

- Ascension Day

- 7 Morning Prayers

- Mysteries of the Rosary

- Litany of the Bl. Virgin Mary

- Popular Saints

- Popular Prayers

- Female Saints

- Saint Feast Days by Month

- Stations of the Cross

- St. Francis of Assisi

- St. Michael the Archangel

- The Apostles' Creed

- Unfailing Prayer to St. Anthony

- Pray the Rosary

St. Catherine of Siena: A Fearless Voice for Christ and the Church

Conclave to Open with Most International College of Cardinals in Church History

A Symbol of Faith, Not Fashion: Cross Necklaces Find Renewed Meaning Among Young Catholics and Public Leaders

Daily Catholic

Daily Readings for Thursday, May 01, 2025

Daily Readings for Thursday, May 01, 2025 St. Marculf: Saint of the Day for Thursday, May 01, 2025

St. Marculf: Saint of the Day for Thursday, May 01, 2025 To Saint Peregrine: Prayer of the Day for Thursday, May 01, 2025

To Saint Peregrine: Prayer of the Day for Thursday, May 01, 2025 Daily Readings for Wednesday, April 30, 2025

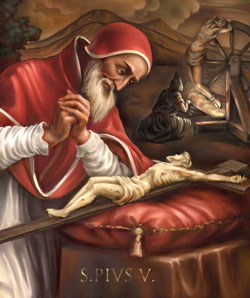

Daily Readings for Wednesday, April 30, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025- Prayer to Saint Joseph for Success in Work: Prayer of the Day for Wednesday, April 30, 2025

![]()

Copyright 2025 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2025 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Thursday, May 01, 2025

Daily Readings for Thursday, May 01, 2025 St. Marculf: Saint of the Day for Thursday, May 01, 2025

St. Marculf: Saint of the Day for Thursday, May 01, 2025 To Saint Peregrine: Prayer of the Day for Thursday, May 01, 2025

To Saint Peregrine: Prayer of the Day for Thursday, May 01, 2025 St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025

St. Pius V, Pope: Saint of the Day for Wednesday, April 30, 2025