Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you. Help Now >

Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you. Help Now >

Lenders lost moorings, some say

FREE Catholic Classes

The Philadelphia Inquirer (MCT) - Did Wall Street greed get in the way of good judgment?

Highlights

McClatchy Newspapers (www.mctdirect.com)

9/22/2008 (1 decade ago)

Published in Business & Economics

Will history show the forced sales of Merrill Lynch & Co. Inc. and parts of Lehman Bros. Holdings Inc. to banks, and the government's bailout of one of the world's largest insurers, American International Group Inc., were wise decisions?

Proper risk management gets drummed into students, finance and business-ethics professors said last week. But when times are good, risk and ethics are frequently forgotten amid easy money and greed.

About every 20 years the U.S. financial system gets rocked by a tsunami, said Bruce Rader, assistant finance professor at Temple University's Fox School of Business. In the 1980s, it was the savings and loan crisis.

What's different now is the financial carnage is more widespread.

"I've been teaching all along about the evils of leverage," Rader said. "Firms that are too much leveraged expose themselves, just like individuals. If you borrow too much money and can't meet your cash flows, you go bankrupt. It's the same thing that's happening on the Street."

Rader said he would teach the same lessons he always has. One element that is new in the credit crisis is phenomenal growth in the derivatives market over the last 20 years. "What's killing a lot of the banks and brokerage firms are the collateralized debt obligations and credit default swaps, two derivatives that are relatively recent," he said.

The teaching of business ethics has always been influenced by financial crises such as insider-trading scandals, or the Enron debacle, said Thomas Donaldson, ethics and legal-studies professor at the Wharton School of the University of Pennsylvania.

The current crisis is the biggest financial storm since the Great Depression, and efforts to shore up Wall Street are unparalleled since the 1930s, he said.

Ethics discussions are likely now to focus on relationships between government and business, and especially between government and the financial-services industry.

In the current crisis, buyers were given loans "when they had no money to put down and no reliable credit," Donaldson said. "Rating agencies were greedy as they marked assets as more secure than they should have been," he said.

Similarly, Wall Street securitized home loans and let collateralized debt obligations pile up. "People on Wall Street knew better and tried to make money in a way that was too risky," Donaldson said.

But greed is part of the human condition, the Wharton professor said. "In business, there's always been a fair amount of greed."

Donaldson sees two ethics topics ripe for discussion with business students:

First, the financial-services industry "acquired a bad habit" of rewarding employees with bonuses and big salaries, only to learn later that deals, especially regarding mortgage debt, carried risks.

A second ethics issue is what he terms "creeping industry precedents" or bad practices that become institutionalized.

"But this is a recurring phenomenon in industry," Donaldson said. "People may have ethical doubts about a practice," but after a while if a whole industry does it, "you think you can't compete" and "the danger becomes normalized."

John J. McCall, professor and director of St. Joseph's University's Pedro Arrupe Center for Business Ethics, said ethics courses taught that financial markets "are only effective when they operate within a background of social institutions and values that limit them."

"What we want to get students to see is that when pure self-interest is not limited by regulatory institutions or by moral values, it almost inevitably leads to serious damage to the public welfare," he said.

McCall said there were ethical lessons to be learned at "every stage" of the subprime-mortgage debacle, from borrowers to brokers, lending banks to investment banks. "There was a culpable refusal to acknowledge risk and historical experience."

"There were people all along who warned about this, but many said, 'Oh, these times are different.'"

"The main lesson here is a repeated lesson that we have to constantly learn over and over again: If people pursue self-interest without paying attention to moral constraints, we have scandals," McCall said.

Though ethics will likely get a more thorough going-over in the classroom now, the practices of employers will continue to have a bigger influence on behavior, said Edward Nelling, finance professor at Drexel University's LeBow College of Business.

"If there is a lesson to be learned, it's ultimately for the leaders, the executives and directors of companies to establish a culture that does not reward unethical behavior," Nelling said.

"Part of the problem now is reward systems were set up for people just based on the volume of business _ 'Let's get these loans written and approved. We're not going to worry so much about the underlying risk.' "

Better behavior, he said, "has to start at the top and work its way down the organization."

___

© 2008, The Philadelphia Inquirer.

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

-

- Easter / Lent

- Ascension Day

- 7 Morning Prayers

- Mysteries of the Rosary

- Litany of the Bl. Virgin Mary

- Popular Saints

- Popular Prayers

- Female Saints

- Saint Feast Days by Month

- Stations of the Cross

- St. Francis of Assisi

- St. Michael the Archangel

- The Apostles' Creed

- Unfailing Prayer to St. Anthony

- Pray the Rosary

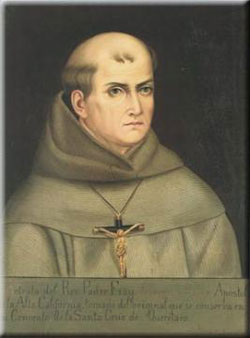

Saint Junípero Serra: Apostle of California and Model of Missionary Zeal

Freedom Rooted in Faith: Simple Ways to Let Christ Illuminate Your Fourth of July

Catholic Online AI Open Letter

Daily Catholic

Daily Readings for Wednesday, July 02, 2025

Daily Readings for Wednesday, July 02, 2025 St. Bernardino Realino: Saint of the Day for Wednesday, July 02, 2025

St. Bernardino Realino: Saint of the Day for Wednesday, July 02, 2025 Prayer for Employment: Prayer of the Day for Wednesday, July 02, 2025

Prayer for Employment: Prayer of the Day for Wednesday, July 02, 2025 Daily Readings for Tuesday, July 01, 2025

Daily Readings for Tuesday, July 01, 2025 St. Junipero Serra: Saint of the Day for Tuesday, July 01, 2025

St. Junipero Serra: Saint of the Day for Tuesday, July 01, 2025- Prayer of the Chalice: Prayer of the Day for Tuesday, July 01, 2025

![]()

Copyright 2025 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2025 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Wednesday, July 02, 2025

Daily Readings for Wednesday, July 02, 2025 St. Bernardino Realino: Saint of the Day for Wednesday, July 02, 2025

St. Bernardino Realino: Saint of the Day for Wednesday, July 02, 2025 Prayer for Employment: Prayer of the Day for Wednesday, July 02, 2025

Prayer for Employment: Prayer of the Day for Wednesday, July 02, 2025 St. Junipero Serra: Saint of the Day for Tuesday, July 01, 2025

St. Junipero Serra: Saint of the Day for Tuesday, July 01, 2025