We ask you, urgently: don't scroll past this

Dear readers, Catholic Online was de-platformed by Shopify for our pro-life beliefs. They shut down our Catholic Online, Catholic Online School, Prayer Candles, and Catholic Online Learning Resources essential faith tools serving over 1.4 million students and millions of families worldwide. Our founders, now in their 70's, just gave their entire life savings to protect this mission. But fewer than 2% of readers donate. If everyone gave just $5, the cost of a coffee, we could rebuild stronger and keep Catholic education free for all. Stand with us in faith. Thank you.Help Now >

Disability Coverage Policies Can Make Good Sense.

FREE Catholic Classes

Disability Coverage Policies Can Make Good Sense. We insure our house, our car, and our life. What about our ability to earn an income?

Highlights

Catholic Online (https://www.catholic.org)

5/23/2006 (1 decade ago)

Published in Business & Economics

In its most basic form, disability insurance is acquired to replace some portion of income that you are incapable of earning during a brief or extended period of incapacitation. What is covered, when it becomes covered, what is paid, for what period all impact the type and cost of the policy you buy.

There are two kinds of disability coverage: Specific occupational coverage, and general occupational coverage. Think of it this way. Specific occupational coverage states that you are covered or insured if you cannot perform your specific occupational pursuit. So if I am a dentist, and I suffer an accident or sickness that leaves an arm paralyzed, I am disabled from my specific occupation, and therefore the company pays me a percentage of my compensation for the period of disability. General occupational coverage only pays if you can do no work whatsoever. So back to our illustration. If I am the disabled dentist, but I can get a job collecting tolls in a highway toll booth or a city parking lot, the general occupational policy will not pay me, because I am capable of getting some type of employment. Minimum wage does not replace a Dentist's practice income.

Additionally, some policies require that you be completely and totally disabled before receiving any benefits. The test can be very demanding, and often, any mobility, or even partial use will invalidate a claim. Remember, an insurance company does not go into the business of insuring claims to pay claims but to make money. Therefore, with the history of fraud specific to disability claims, often the feature of television news programs, insurance companies will want to be sure you are actually disabled before they send you a check.Â

What will the policy pay? It is possible to buy a policy that actually pays 100% of your lost professional income, but it is cost prohibitive. Generally, policies that pay 50-70% of your lost income are more affordable, and therefore much more practical. Some expenses go up if a person is disabled, but other expenses may be significantly reduced as a result of the disability.

Are there other sources of assistance? There is a limited coverage available through Social Security, and other coverage is available through State sponsored plans. The best planning takes into account all resources, and maintains a safety net.

How do you save money on disability coverage and have peace of mind? Self insurance through the first six months or year is a sure way to cut your premiums dramatically. In that most disabilities of a temporary nature are over within six to nine months, by extending the "deductible" period to not cover the first six months of a disability, you have released the insurance company from first dollar coverage, and therefore significantly lowered your expense. If you possibly can, take a year deductible, get at least sixty percent of your professional income, and you can have a policy in place that addresses the ultimate risk of a disabling experience: The cost of a lost lifetime of income.Â

Talk to your agent or to your employer's agent about the mix of time deductibles and benefits to come up with a plan to insure this risk without sacrificing your financial health to obtain this important coverage.

---

'Help Give every Student and Teacher FREE resources for a world-class Moral Catholic Education'

Copyright 2021 - Distributed by Catholic Online

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

-

- Easter / Lent

- Ascension Day

- 7 Morning Prayers

- Mysteries of the Rosary

- Litany of the Bl. Virgin Mary

- Popular Saints

- Popular Prayers

- Female Saints

- Saint Feast Days by Month

- Stations of the Cross

- St. Francis of Assisi

- St. Michael the Archangel

- The Apostles' Creed

- Unfailing Prayer to St. Anthony

- Pray the Rosary

Digital Drug: How Social Media Algorithms Are Addicting and Rewiring Our Brains

A Generation Without Christ Breeds Violence — The Answer Is Catholic Education

Rediscovering the Face of God in Others: Pope Leo’s Call to Fraternity

Daily Catholic

Daily Readings for Saturday, September 13, 2025

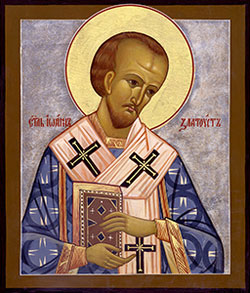

Daily Readings for Saturday, September 13, 2025 St. John Chrysostom: Saint of the Day for Saturday, September 13, 2025

St. John Chrysostom: Saint of the Day for Saturday, September 13, 2025 A Prayer for the Gift of Wisdom: Prayer of the Day for Saturday, September 13, 2025

A Prayer for the Gift of Wisdom: Prayer of the Day for Saturday, September 13, 2025 Daily Readings for Friday, September 12, 2025

Daily Readings for Friday, September 12, 2025 St. Ailbhe: Saint of the Day for Friday, September 12, 2025

St. Ailbhe: Saint of the Day for Friday, September 12, 2025- Family Prayer Time: Prayer of the Day for Friday, September 12, 2025

![]()

Copyright 2025 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2025 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Saturday, September 13, 2025

Daily Readings for Saturday, September 13, 2025 St. John Chrysostom: Saint of the Day for Saturday, September 13, 2025

St. John Chrysostom: Saint of the Day for Saturday, September 13, 2025 A Prayer for the Gift of Wisdom: Prayer of the Day for Saturday, September 13, 2025

A Prayer for the Gift of Wisdom: Prayer of the Day for Saturday, September 13, 2025 St. Ailbhe: Saint of the Day for Friday, September 12, 2025

St. Ailbhe: Saint of the Day for Friday, September 12, 2025